Sears 2015 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2015 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

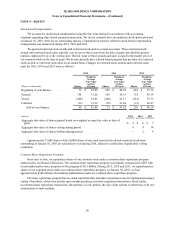

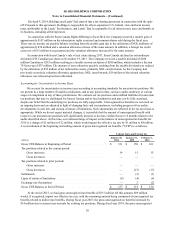

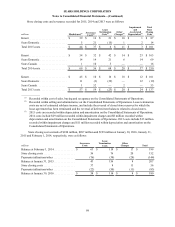

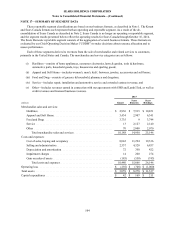

2015

millions Kmart

Sears

Domestic

Sears

Holdings

Gain . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $154 $471 $625

Loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (17)(100)(117)

Immediate Net Gain. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $137 $371 $508

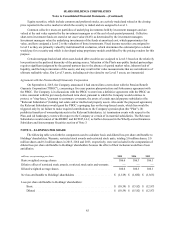

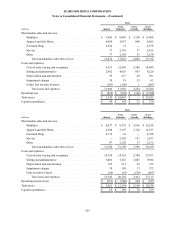

The remaining gain of $894 million was deferred and will be recognized in proportion to the related rent

expense, which is a component of Cost of sales, buying and occupancy, on the Consolidated Statement of

Operations, over the lease term. At January 30, 2016, $89 million of the deferred gain on sale-leaseback is classified

as current within other current liabilities and $753 million is classified as long-term as deferred gain on sale-

leaseback on the Consolidated Balance Sheets.

Holdings accounted for the four properties that have continuing involvement as a financing transaction in

accordance with accounting standards related to sale-leaseback transactions. Accordingly, Holdings recorded a sale-

leaseback financing obligation of $164 million, which is classified as sale-leaseback financing obligation on the

Consolidated Balance Sheet at January 30, 2016. The decrease in the sale-leaseback financing obligation from $426

million at May 2, 2015 to $164 million at January 30, 2016 represents a noncash change. We continued to report the

real property assets of $56 million at January 30, 2016 on our Consolidated Balance Sheets, which are included in

our Sears Domestic segment.

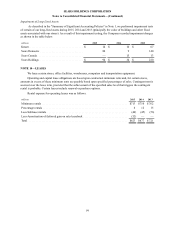

The obligation for future minimum lease payments at January 30, 2016 for the four properties that have

continuing involvement is $103 million over the 10 year lease term, and is $10 million for each of 2016, 2017, 2018,

and 2019, respectively, and $11 million for 2020 and $50 million thereafter. This obligation for future minimum

lease payments includes $58 million of rent on behalf of a third-party tenant over the 10 year lease term. We will no

longer have the obligation to pay rent on behalf of the third-party tenant when it commences rent payments to the

JVs, which we expect to occur within one to two years.

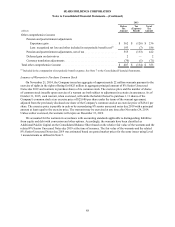

In addition to the Seritage transaction and JV transactions, we recorded gains on the sales of assets for other

significant items described as follows. During 2015, we recorded gains on the sales of assets of $83 million

recognized on the sale of one Sears Full-line store for which we received $102 million of cash proceeds, $90 million

of which was received during the third quarter of 2014. As the leaseback ended and the remaining cash proceeds of

$12 million were received during 2015, we recognized the gain that had previously been deferred. We also recorded

gains on the sales of assets of $86 million recognized on the sale of two Sears Full-line stores for which we received

$96 million of cash proceeds, and $10 million recognized on the surrender and early termination of one Kmart store

lease.

During 2014, we recorded gains on the sales of assets of $207 million in connection with real estate

transactions, which included a gain of $64 million recognized on the sale of three Sears Full-line stores for which we

received $106 million of cash proceeds, $13 million recognized on the sale of a distribution facility in our Sears

Domestic segment for which we received $16 million of cash proceeds and a gain of $10 million recognized on the

sale of a Kmart store for which we received $10 million of cash proceeds.

During 2013, we recorded gains on sales of assets of $180 million recognized on the amendment and early

termination of the leases on two properties operated by Sears Canada for which Sears Canada received $184 million

($191 million Canadian) in cash proceeds. Additionally, in 2013, we recorded gains on sales of assets of $357

million recognized on the surrender and early termination of the leases of five properties operated by Sears Canada,

for which Sears Canada received $381 million ($400 million Canadian) in cash proceeds. Gains on sales of assets

recorded during 2013 also include gains of $67 million related to the sale of one store previously operated under The

Great Indoors format, two Sears Full-line stores and two Kmart stores for which we received $98 million in cash

proceeds.

One of the gains recognized in 2013 was for the surrender and early termination of one lease operated by

Sears Canada. We surrendered all of our rights and obligations under our preexisting lease agreement related to

certain floors, and agreed to surrender these premises by March 2014. Sears Canada will continue to lease floors

currently used as office space under terms consistent with the existing lease. We determined that there is no

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

95