Sears 2015 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2015 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

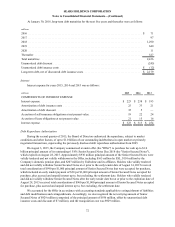

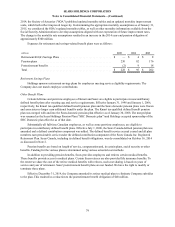

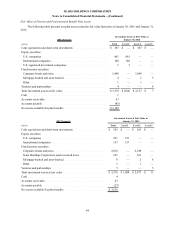

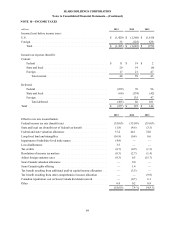

Weighted-average assumptions used to determine net cost were as follows:

2015 2014 2013

SHC

Domestic

SHC

Domestic

Sears

Canada

SHC

Domestic

Sears

Canada

Pension benefits:

Discount Rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.70% 4.60% 4.20% 4.25% 4.20%

Return of plan assets . . . . . . . . . . . . . . . . . . . . . . . 7.00% 7.00% 6.50% 7.00% 6.50%

Rate of compensation increases . . . . . . . . . . . . . . . N/A N/A 3.50% N/A 3.50%

Postretirement benefits:

Discount Rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.30% 4.00% 3.90% 3.55% 4.20%

Return of plan assets . . . . . . . . . . . . . . . . . . . . . . . N/A N/A 1.00% N/A 3.75%

Rate of compensation increases . . . . . . . . . . . . . . . N/A N/A 3.50% N/A 3.50%

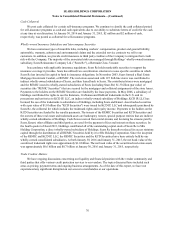

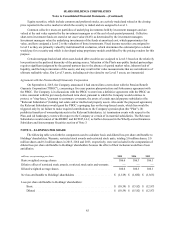

For purposes of determining the periodic expense of our defined benefit plans, we use the fair value of plan

assets as the market related value. A one-percentage-point change in the assumed discount rate would have the

following effects on the pension liability:

millions

1€percentage-point

Increase

1€percentage-point

Decrease

Effect on interest cost component . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $23 $(30)

Effect on pension benefit obligation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(498) $ 596

Approximately $255 million of the unrecognized net losses in accumulated other comprehensive income are

expected to be amortized as a component of net periodic benefit cost during 2016.

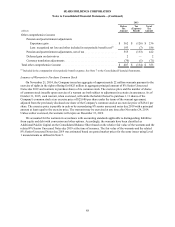

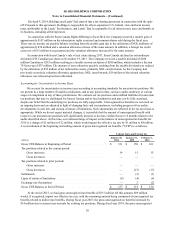

Investment Strategy

The Investment Committee, made up of select members of senior management, has appointed a non-affiliated

third party professional to advise the Committee with respect to the SHC domestic pension plan assets. The plan's

overall investment objective is to provide a long-term return that, along with Company contributions, is expected to

meet future benefit payment requirements. A long-term horizon has been adopted in establishing investment policy

such that the likelihood and duration of investment losses are carefully weighed against the long-term potential for

appreciation of assets. The plan's investment policy requires investments to be diversified across individual

securities, industries, market capitalization and valuation characteristics. In addition, various techniques are utilized

to monitor, measure and manage risk.

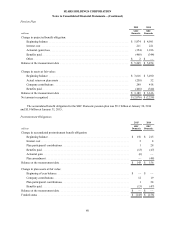

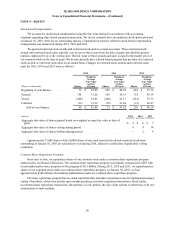

Domestic plan assets were invested in the following classes of securities:

€

Plan Assets at

January 30,

2016

January 31,

2015

Equity securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34%33%

Fixed income and other debt securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 63 63

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 4

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 100%100%

The domestic plan's target allocation is determined by taking into consideration the amounts and timing of

projected liabilities, our funding policies and expected returns on various asset classes. At January€30, 2016, the

plan's target asset allocation was 35% equity and 65% fixed income. To develop the expected long-term rate of

return on assets assumption, we considered the historical returns and the future expectations for returns for each

asset class, as well as the target asset allocation of the pension portfolio.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

82