Sears 2015 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2015 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

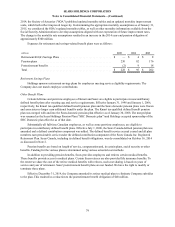

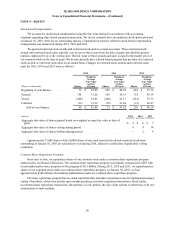

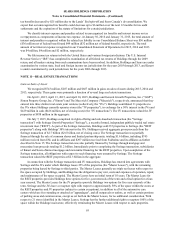

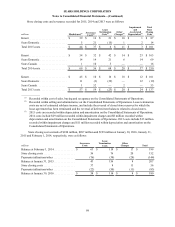

2013

millions

Before

Tax

Amount

Tax

(Expense)

Benefit

Net of

Tax

Amount

Other comprehensive income

Pension and postretirement adjustments

Experience gain . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $362 $(126) $ 236

Less: recognized net loss and other included in net periodic benefit cost(1) . . 193 (7)186

Pension and postretirement adjustments, net of tax . . . . . . . . . . . . . . . . . . . . . . . 555 (133)422

Deferred gain on derivatives. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 — 2

Currency translation adjustments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (70)(1)(71)

Total other comprehensive income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $487 $(134) $ 353

(1) Included in the computation of net periodic benefit expense. See Note 7 to the Consolidated Financial Statements.

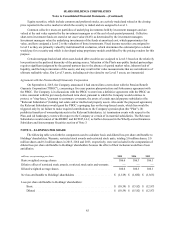

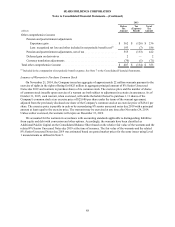

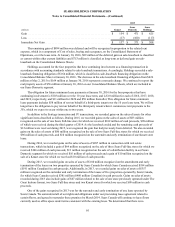

Issuance of Warrants to Purchase Common Stock

On November 21, 2014, the Company issued an aggregate of approximately 22 million warrants pursuant to the

exercise of rights in the rights offering for $625 million in aggregate principal amount of 8% Senior Unsecured

Notes due 2019 and warrants to purchase shares of its common stock. The exercise price and the number of shares

of common stock issuable upon exercise of a warrant are both subject to adjustment in certain circumstances. As of

October 31, 2015, each warrant, when exercised, will entitle the holder thereof to purchase 1.11 shares of the

Company's common stock at an exercise price of $25.686 per share under the terms of the warrant agreement,

adjusted from the previously disclosed one share of the Company's common stock at an exercise price of $28.41 per

share. The exercise price is payable in cash or by surrendering 8% senior unsecured notes due 2019 with a principal

amount at least equal to the exercise price. The warrants may be exercised at any time after November 24, 2014.

Unless earlier exercised, the warrants will expire on December 15, 2019.

We accounted for the warrants in accordance with accounting standards applicable to distinguishing liabilities

from equity and debt with conversion and other options. Accordingly, the warrants have been classified as

Additional Paid-In Capital on the Consolidated Balance Sheet based on the relative fair value of the warrants and the

related 8% Senior Unsecured Notes due 2019 at the time of issuance. The fair value of the warrants and the related

8% Senior Unsecured Notes due 2019 was estimated based on quoted market prices for the same issues using Level

1 measurements as defined in Note 5.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

88