Sears 2015 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2015 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

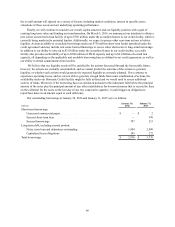

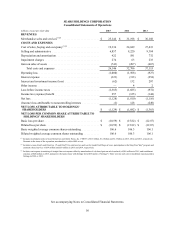

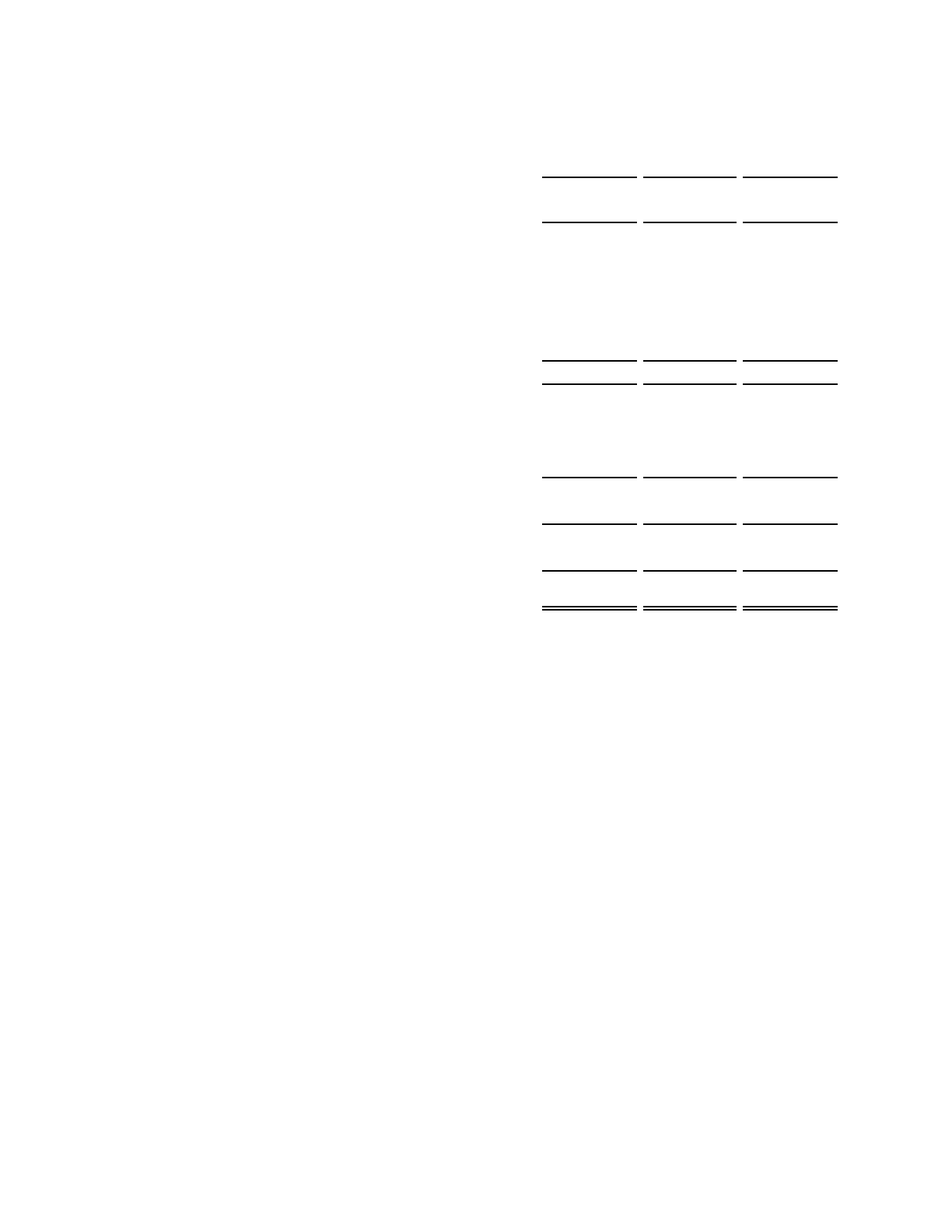

SEARS HOLDINGS CORPORATION

Consolidated Statements of Operations

millions, except per share data 2015 2014 2013

REVENUES

Merchandise sales and services(1)(2) . . . . . . . . . . . . . . . . . . . . . . . . . . $25,146 $31,198 $36,188

COSTS AND EXPENSES

Cost of sales, buying and occupancy(1)(3) . . . . . . . . . . . . . . . . . . . . . . 19,336 24,049 27,433

Selling and administrative . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,857 8,220 9,384

Depreciation and amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 422 581 732

Impairment charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 274 63 233

Gain on sales of assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (743)(207)(667)

Total costs and expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26,146 32,706 37,115

Operating loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,000)(1,508)(927)

Interest expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (323)(313)(254)

Interest and investment income (loss) . . . . . . . . . . . . . . . . . . . . . . . . (62)132 207

Other income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 4 2

Loss before income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,385)(1,685)(972)

Income tax (expense) benefit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 257 (125)(144)

Net loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,128)(1,810)(1,116)

(Income) loss attributable to noncontrolling interests . . . . . . . . . . . . (1)128 (249)

NET LOSS ATTRIBUTABLE TO HOLDINGS’

SHAREHOLDERS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(1,129) $ (1,682) $ (1,365)

NET LOSS PER COMMON SHARE ATTRIBUTABLE TO

HOLDINGS’ SHAREHOLDERS

Basic loss per share. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(10.59) $ (15.82) $ (12.87)

Diluted loss per share . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(10.59) $ (15.82) $ (12.87)

Basic weighted average common shares outstanding. . . . . . . . . . . . . 106.6 106.3 106.1

Diluted weighted average common shares outstanding . . . . . . . . . . . 106.6 106.3 106.1

(1) Includes merchandise sales to Sears Hometown and Outlet Stores, Inc. ("SHO") of $1.3 billion, $1.4 billion and $1.5 billion in 2015, 2014 and 2013, respectively.

Pursuant to the terms of the separation, merchandise is sold to SHO at cost.

(2) Includes revenue from Lands' End, Inc. ("Lands' End") for retail services and rent for Lands' End Shops at Sears, participation in the Shop Your Way® program and

corporate shared services of $59 million and $59 million in 2015 and 2014, respectively.

(3) Includes rent expense (consisting of straight-line rent expense offset by amortization of a deferred gain on sale-leaseback) of $49 million in 2015, and installment

expenses of $40 million in 2015, pursuant to the master lease with Seritage Growth Properties ("Seritage"). There were no such rent or installment expenses paid to

Seritage in 2014 or 2013.

See accompanying Notes to Consolidated Financial Statements.

56