Sears 2015 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2015 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

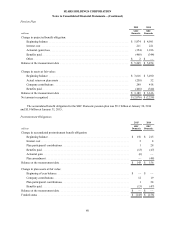

2014, the Society of Actuaries ("SOA") published updated mortality tables and an updated mortality improvement

scale, which both reflect improved longevity. In determining the appropriate mortality assumptions as of January 31,

2015, we considered the SOA’s updated mortality tables, as well as other mortality information available from the

Social Security Administration to develop assumptions aligned with our expectation of future improvement rates.

The change to the mortality rate assumptions resulted in an increase in the 2014 year-end pension obligation of

approximately $300 million.

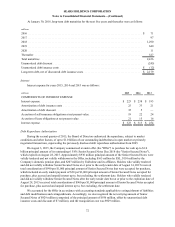

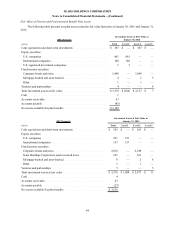

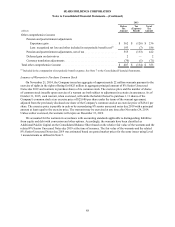

Expenses for retirement and savings-related benefit plans were as follows:

millions 2015 2014 2013

Retirement/401(k) Savings Plans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $—$4$8

Pension plans. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 230 82 176

Postretirement benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2)9 18

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $228 $95 $202

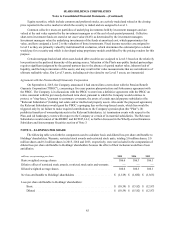

Retirement Savings Plans

Holdings sponsors retirement savings plans for employees meeting service eligibility requirements. The

Company does not match employee contributions.

Other Benefit Plans

Certain full-time and part-time employees of Kmart and Sears are eligible to participate in noncontributory

defined benefit plans after meeting age and service requirements. Effective January 31, 1996 and January 1, 2006,

respectively, the Kmart tax-qualified defined benefit pension plan and the Sears domestic pension plans were frozen

and associates no longer earn additional benefits under the plan. The Kmart tax-qualified defined benefit pension

plan was merged with and into the Sears domestic pension plan effective as of January 30, 2008. The merged plan

was renamed as the Sears Holdings Pension Plan ("SHC Domestic plan") and Holdings accepted sponsorship of the

SHC Domestic plan effective as of that date.

Substantially all full-time Canadian employees, as well as some part-time employees, are eligible to

participate in contributory defined benefit plans. Effective July€1, 2008, the Sears Canada defined pension plan was

amended and a defined contribution component was added. The defined benefit service accrual ceased and all plan

members earn pensionable service under the defined contribution component of the Sears Canada Inc. Registered

Retirement Plan. Sears Canada, including its defined benefit obligations, was de-consolidated on October 16, 2014

as discussed in Note 2.

Pension benefits are based on length of service, compensation and, in certain plans, social security or other

benefits. Funding for the various plans is determined using various actuarial cost methods.

In addition to providing pension benefits, Sears provides employees and retirees certain medical benefits.

These benefits provide access to medical plans. Certain Sears retirees are also provided life insurance benefits. To

the extent we share the cost of the retiree medical benefits with retirees, such cost sharing is based on years of

service and year of retirement. Sears' postretirement benefit plans are not funded. We have the right to modify or

terminate these plans.

Effective December 31, 2014, the Company amended its retiree medical plan to eliminate Company subsidies

to the plan. This resulted in a reduction to the postretirement benefit obligation of $48 million.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

79