Sears 2015 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2015 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

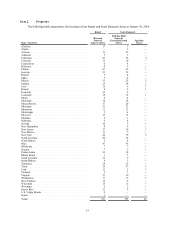

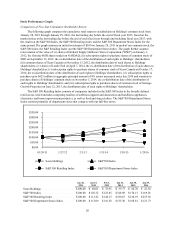

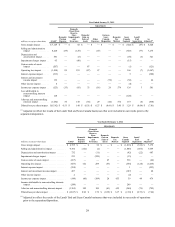

References to comparable store sales amounts within the following discussion include sales for all stores

operating for a period of at least 12 full months, including remodeled and expanded stores, but excluding store

relocations and stores that have undergone format changes. Domestic comparable store sales amounts include sales

from sears.com and kmart.com shipped directly to customers. These online sales resulted in a negative impact to our

domestic comparable store sales results of approximately 10 basis points for 2015 and a benefit of 120 basis points

for 2014. In addition, domestic comparable store sales have been adjusted for the change in the unshipped sales

reserves recorded at the end of each reporting period, which resulted in a positive impact of approximately 10 basis

points and a negative impact of 10 basis points for 2015 and 2014, respectively.

Domestic comparable store sales results for 2015 were calculated based on the 52-week period ended

January€30, 2016 as compared to the comparable 52-week period in the prior year, while domestic comparable store

sales results for 2014 were calculated based on the 52-week period ended January€31, 2015 as compared to the

comparable 52-week period in the prior year.

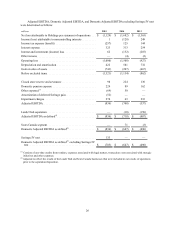

2015 Compared to 2014

Net Loss Attributable to Holdings' Shareholders

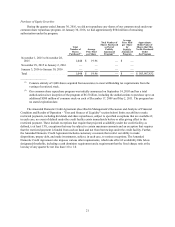

We recorded a net loss attributable to Holdings' shareholders of $1.1 billion ($10.59 loss per diluted share) and

$1.7 billion ($15.82 loss per diluted share) for 2015 and 2014, respectively. Our results for 2015 and 2014 were

affected by a number of significant items. Our net loss as adjusted for these significant items, which are further

discussed below, was $953 million ($8.94 loss per diluted share) for 2015 and $830 million ($7.81 loss per diluted

share) for 2014. The increase in net loss as adjusted for the year primarily reflected a decline in gross margin, which

was driven by the decline in revenues, partially offset by a decrease in selling and administrative expenses.

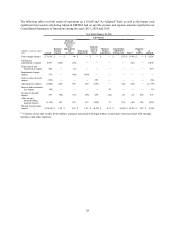

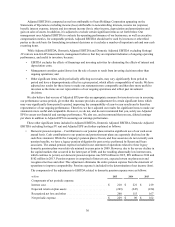

In addition to our net loss attributable to Sears Holdings' shareholders determined in accordance with

Generally Accepted Accounting Principles ("GAAP"), for purposes of evaluating operating performance, we use

Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization ("Adjusted EBITDA"), Domestic Adjusted

EBITDA and Domestic Adjusted EBITDA excluding Seritage/JV rent as well as Adjusted Earnings per Share

("Adjusted EPS"). Domestic Adjusted EBITDA, excluding Seritage/JV rent, reflects the impact of the additional rent

expense and assigned sub-tenant rental income as a result of the Seritage and JV transactions. The terms of our

leases with Seritage and the JVs provide us with the ability to accelerate the transformation of our physical stores.

We expect that our cash rent obligation will decrease significantly as space in these stores is recaptured.

25