Sears 2015 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2015 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

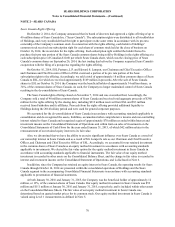

Unsecured Commercial Paper

We borrow through the commercial paper markets. At January€30, 2016, we had no commercial paper

borrowings outstanding, while at January€31, 2015, we had outstanding commercial paper borrowings of $2 million.

Secured Short-Term Loan

On September 15, 2014, the Company, through Sears, Sears Development Co. and Kmart Corporation ("Short-

Term Borrowers"), entities wholly-owned and controlled, directly or indirectly by the Company, entered into a $400

million secured short-term loan (the "Short-Term Loan'") with JPP II, LLC and JPP, LLC (together, the "Short-Term

Lender"), entities affiliated with ESL and Fairholme. The first $200 million of the Short-Term Loan was funded at

the closing on September 15, 2014 and the remaining $200 million was funded on September 30, 2014. Proceeds of

the Short-Term Loan were used for general corporate purposes.

The Short-Term Loan was originally scheduled to mature on December 31, 2014. As permitted by the Short-

Term Loan agreement, the Company paid an extension fee equal to 0.5% of the principal amount to extend the

maturity date to February 28, 2015. The Short-Term Loan had an annual base interest rate of 5%. The Short-Term

Borrowers paid an upfront fee of 1.75% of the full principal amount. The Short-Term Loan was guaranteed by the

Company and was secured by a first priority lien on certain real properties owned by the Short-Term Borrowers.

On February 25, 2015, we entered into an agreement effective February 28, 2015, to amend and extend the

$400 million secured short-term loan. Under the terms of the amendment, we repaid $200 million of the $400

million on March 2, 2015 and the remaining $200 million on June 1, 2015, resulting in no balance outstanding at

January 30, 2016. At January€31, 2015, the outstanding balance of the Short-Term Loan was $400 million. During

2015, the Short-Term Borrowers paid interest of $6 million to the Short-Term Lender. During 2014, the Short-Term

Borrowers paid an upfront fee of $7 million, an extension fee of $2 million and interest of $6 million to the Short-

Term Lender.

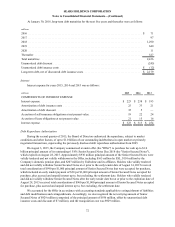

Domestic Credit Agreement

During the first quarter of 2011, SRAC, Kmart Corporation (together with SRAC, the "Borrowers") and

Holdings entered into an amended credit agreement (the "Domestic Credit Agreement"). On October 2, 2013,

Holdings and the Borrowers entered into a First Amendment (the "Amendment") to the Domestic Credit Agreement

with a syndicate of lenders. Pursuant to the Amendment, the Borrowers borrowed $1.0 billion under a new senior

secured term loan facility (the "Term Loan"). On July 21, 2015, the Borrowers and Holdings entered into an

amended and restated credit agreement (the "Amended Domestic Credit Agreement") with a syndicate of lenders

that amended and restated the then-existing Domestic Credit Agreement. The Amended Domestic Credit Agreement

provides a $3.275 billion asset-based revolving credit facility (the "Revolving Facility") with a $1.0 billion letter of

credit sub-facility. The maturity date for $1.971 billion of the Revolving Facility has been extended to July€20, 2020,

while $1.304 billion retains the existing maturity date of April 8, 2016. The Amended Domestic Credit Agreement

also governs the existing Term Loan, which retains its maturity date of June€30, 2018. The Amended Domestic

Credit Agreement includes an accordion feature that allows the Borrowers to use existing collateral for the facility to

obtain up to $1.0 billion of additional borrowing capacity, subject to borrowing base requirements, as well as a

"FILO" ("first in last out") tranche feature that allows an additional $500 million of borrowing capacity. The

Amended Domestic Credit Agreement also increases Holdings' ability to undertake short-term borrowings from

$500 million to $750 million. On March 3, 2016, we announced our intention to obtain a new senior secured term

loan facility of up to $750 million under the accordion feature in our credit facility, which is currently being

marketed to potential lenders.

Revolving advances under the Amended Domestic Credit Agreement bear interest at a rate equal to, at the

election of the Borrowers, either the London Interbank Offered Rate ("LIBOR") or a base rate, in either case plus an

applicable margin dependent on Holdings' consolidated leverage ratio (as measured under the Amended Domestic

Credit Agreement). The margin with respect to borrowings under the extended commitments ranges from 3.25% to

3.75% for LIBOR loans and from 2.25% to 2.75% for base rate loans. The margin with respect to borrowings under

the non-extended commitments remains 2.00% to 2.50% for LIBOR loans and 1.00% to 1.50% for base rate loans.

The Amended Domestic Credit Agreement also provides for the payment of fees with respect to issued and undrawn

letters of credit at a rate equal to the margin applicable to LIBOR loans and a commitment fee with respect to

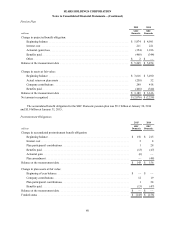

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

73