Sears 2015 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2015 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

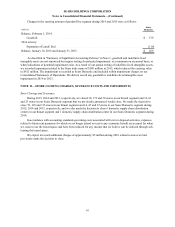

tax services, logistics services, auditing and compliance services, inventory management services, information

technology services and continued participation in certain contracts shared with Holdings and its subsidiaries, as

well as agreements related to Lands' End Shops at Sears and participation in the Shop Your Way® program. The

majority of the services under the transition services agreement with Lands' End have expired or been terminated.

Amounts due to or from Lands’ End are non-interest bearing, and generally settled on a net basis. Holdings

invoices Lands' End on at least a monthly basis. At January€30, 2016, Holdings reported a net amount payable to

Lands' End of $1 million in the other current liabilities line of the Consolidated Balance Sheet. At January 31, 2015,

Holdings reported a net amount receivable from Lands' End of $5 million in the accounts receivable line of the

Consolidated Balance Sheet. Amounts related to revenue from retail services and rent for Lands' End Shops at Sears,

participation in the Shop Your Way® program and corporate shared services were $69 million and $63 million,

respectively, during 2015 and 2014. The amounts Lands' End earned related to call center services and commissions

were $10 million and $9 million, respectively, during 2015 and 2014.

SHO

ESL owns approximately 51% of the outstanding common stock of SHO (based on publicly available

information as of February 9, 2016). Holdings and certain of its subsidiaries engage in transactions with SHO

pursuant to various agreements with SHO which, among other things, (1) govern the principal transactions relating

to the rights offering and certain aspects of our relationship with SHO following the separation, (2) establish terms

under which Holdings and certain of its subsidiaries will provide SHO with services, and (3) establish terms

pursuant to which Holdings and certain of its subsidiaries will obtain merchandise for SHO.

These agreements were made in the context of a parent-subsidiary relationship and were negotiated in the

overall context of the separation. A summary of the nature of related party transactions involving SHO is as follows:

• SHO obtains a significant amount of its merchandise from the Company. We have also entered into certain

agreements with SHO to provide logistics, handling, warehouse and transportation services. SHO also pays

a royalty related to the sale of Kenmore, Craftsman and DieHard products and fees for participation in the

Shop Your Way® program.

• SHO receives amounts from the Company for the sale of merchandise made through www.sears.com,

extended service agreements, delivery and handling services and credit revenues.

• The Company provides SHO with shared corporate services. These services include accounting and

finance, human resources, information technology and real estate.

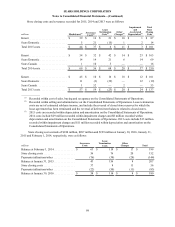

Amounts due to or from SHO are non-interest bearing, settled on a net basis, and have payment terms of 10

days after the invoice date. The Company invoices SHO on a weekly basis. At January€30, 2016 and January€31,

2015, Holdings reported a net amount receivable from SHO of $51 million and $61 million, respectively, in the

Accounts receivable line of the Consolidated Balance Sheet. Amounts related to the sale of inventory and related

services, royalties, and corporate shared services were $1.5 billion during 2015, $1.6 billion during 2014 and $1.7

billion during 2013. The net amounts SHO earned related to commissions were $91 million during 2015, $99

million during 2014 and $89 million during 2013. Additionally, the Company has guaranteed lease obligations for

certain SHO store leases that were assigned as a result of the separation. See Note 4 for further information related

to these guarantees.

Also in connection with the separation, the Company entered into an agreement with SHO and the agent under

SHO's secured credit facility, whereby the Company committed to continue to provide services to SHO in

connection with a realization on the lender's collateral after default under the secured credit facility, notwithstanding

SHO's default under the underlying agreement with us, and to provide certain notices and services to the agent, for

so long as any obligations remain outstanding under the secured credit facility.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

102