Sears 2015 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2015 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

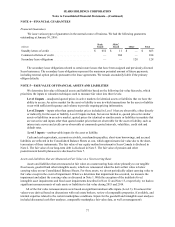

Notes were issued contains restrictive covenants that, among other things, (1)€limit the ability of the Company and

certain of its domestic subsidiaries to create liens and enter into sale and leaseback transactions and (2)€limit the

ability of the Company to consolidate with or merge into, or sell other than for cash or lease all or substantially all of

its assets to, another person. The indenture also provides for certain events of default, which, if any were to occur,

would permit or require the principal and accrued and unpaid interest on all the then outstanding Senior Secured

Notes to be due and payable immediately. Generally, the Company is required to offer to repurchase all outstanding

Senior Secured Notes at a purchase price equal to 101% of the principal amount if the borrowing base (as calculated

pursuant to the indenture) falls below the principal value of the Senior Secured Notes plus any other indebtedness

for borrowed money that is secured by liens on the Collateral for two consecutive quarters or upon the occurrence of

certain change of control triggering events. The Company may call the Senior Secured Notes at a premium based on

the "Treasury Rate" as defined in the indenture, plus 50 basis points. On September€6, 2011, we completed our offer

to exchange the Senior Secured Notes held by nonaffiliates for a new issue of substantially identical notes registered

under the Securities Act of 1933, as amended. As discussed above, the Company completed the Offer for $936

million principal amount of its outstanding Senior Secured Notes during 2015. The carrying value of Senior Secured

Notes, net of the remaining discount and debt issuance costs, was $0.3 billion and $1.2 billion at January 30, 2016

and January€31, 2015, respectively.

Senior Unsecured Notes

On October 20, 2014, the Company announced its board of directors had approved a rights offering allowing

its stockholders to purchase up to $625 million in aggregate principal amount of 8% senior unsecured notes due

2019 and warrants to purchase shares of its common stock. The subscription rights were distributed to all

stockholders of the Company as of October 30, 2014, the record date for this rights offering, and every stockholder

had the right to participate on the same terms in accordance with its pro rata ownership of the Company's common

stock, except that holders of the Company's restricted stock that was unvested as of the record date received cash

awards in lieu of subscription rights. This rights offering closed on November 18, 2014 and was oversubscribed.

Accordingly, on November 21, 2014, the Company issued $625 million aggregate original principal amount of

8% senior unsecured notes due 2019 (the "Senior Unsecured Notes") and received proceeds of $625 million which

were used for general corporate purposes. The Senior Unsecured Notes are the unsecured and unsubordinated

obligations of the Company and rank equal in right of payment with the existing and future unsecured and

unsubordinated indebtedness of the Company. The Senior Unsecured Notes bear interest at a rate of 8% per annum

and the Company will pay interest semi-annually on June 15 and December 15 of each year. The Senior Unsecured

Notes are not guaranteed.

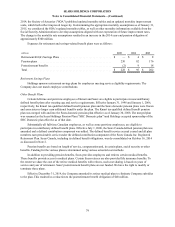

We accounted for the Senior Unsecured Notes in accordance with accounting standards applicable to

distinguishing liabilities from equity and debt with conversion and other options. Accordingly, we allocated the

proceeds received for the Senior Unsecured Notes based on the relative fair values of the Senior Unsecured Notes

and warrants, which resulted in a discount to the notes of approximately $278 million. The fair value of the Senior

Unsecured Notes and warrants was estimated based on quoted market prices for the same issues using Level 1

measurements as defined in Note 5. The discount is being amortized over the life of the Senior Unsecured Notes

using the effective interest method with an effective interest rate of 11.55%. Approximately $5 million of the

discount was amortized during 2014, resulting in a remaining discount of approximately $273 million at January 31,

2015. The book value of the Senior Unsecured Notes net of the remaining discount and debt issuance costs was

approximately $348 million at January 31, 2015. Approximately $35 million of the discount was amortized during

2015, resulting in a remaining discount of approximately $238 million at January 30, 2016. The book value of the

Senior Unsecured Notes net of the remaining discount and debt issuance costs was approximately $383 million at

January 30, 2016.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

75