Sears 2015 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2015 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

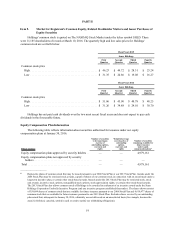

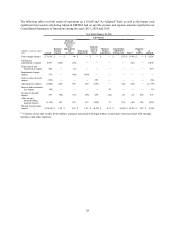

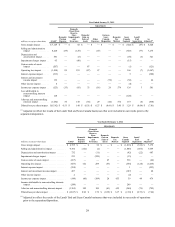

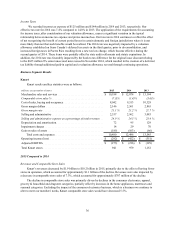

The following tables set forth results of operations on a GAAP and "As Adjusted" basis, as well as the impact each

significant item used in calculating Adjusted EBITDA had on specific income and expense amounts reported in our

Consolidated Statements of Operations during the years 2015, 2014 and 2013.

Year Ended January 30, 2016

Adjustments

millions, except per share

data GAAP

Domestic

Pension

Expense

Domestic

Closed€Store

Reserve,

Store

Impairments

and

Severance

Trade name

Impairment

Domestic

Gain on

Sales of

Assets

Mark-to-

Market

Adjustments

Amortization

of Deferred

Seritage Gain Other(1)

Domestic

Tax

Matters

As

Adjusted

Gross margin impact . . $5,810 $—$44 $—$—$—$(52) $ (146) $ —$5,656

Selling and

administrative impact .6,857 (229)(54)— — — — (82)— 6,492

Depreciation and

amortization impact 422 — (3)— — — — — — 419

Impairment charges

impact . . . . . . . . . . . . . 274 — (94)(180)— — — — — —

Gain on sales of assets

impact . . . . . . . . . . . . . (743)— — — 687 — — — — (56)

Operating loss impact .(1,000)229 195 180 (687)— (52)(64)— (1,199)

Interest and investment

loss impact . . . . . . . (62)— — — — 59 — — — (3)

Income tax benefit

impact . . . . . . . . . . . . . 257 (86)(73)(68)258 (22)20 24 263 573

After tax and

noncontrolling

interests impact . . . .

(1,129)143 122 112 (429)37 (32)(40)263 (953)

Diluted loss per share

impact . . . . . . . . . . . . . $(10.59) $ 1.34 $1.14 $1.05 $(4.02) $ 0.35 $(0.30) $ (0.38) $ 2.47 $(8.94)

(1) Consists of one-time credits from vendors, expenses associated with legal matters, transaction costs associated with strategic

initiatives and other expenses.

28