Sears 2015 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2015 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

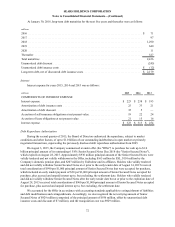

continued to report unamortized debt issuance costs related to the Revolving Facility of $49 million and $16 million

at January€30, 2016 and January€31, 2015, respectively, within other assets.

Consolidation

In February 2015, the FASB issued an accounting standards update which revises the consolidation model.

Specifically, the amendments modify the evaluation of whether limited partnerships and similar legal entities are

variable interest entities (VIEs) or voting interest entities, eliminate the presumption that a general partner should

consolidate a limited partnership, affect the consolidation analysis of reporting entities that are involved with VIEs,

particularly those that have fee arrangements and related party relationships, and provide a scope exception from

consolidation guidance for reporting entities with interests in legal entities that are required to comply with or

operate in accordance with requirements that are similar to those in Rule 2a-7 of the Investment Company Act of

1940 for registered money market funds. This update was effective and adopted by the Company in the first quarter

of 2015. The adoption of the new standard did not have a material impact on the Company’s consolidated financial

position, results of operations, cash flows or disclosures.

Determining Whether the Host Contract in a Hybrid Financial Instrument Issued in the Form of a Share Is More

Akin to Debt or to Equity

In November 2014, the FASB issued an accounting standards update which clarifies how current GAAP should

be interpreted in evaluating the economic characteristics and risks of a host contract in a hybrid financial instrument

that is issued in the form of a share. Specifically, the amendments clarify that an entity should consider all relevant

terms and features-including the embedded derivative feature being evaluated for bifurcation-in evaluating the

nature of the host contract. Furthermore, the amendments clarify that no single term or feature would necessarily

determine the economic characteristics and risks of the host contract. Rather, the nature of the host contract depends

upon the economic characteristics and risks of the entire hybrid financial instrument. This update was effective for

the Company in the first quarter of 2015. The adoption of the new standard did not have a material impact on the

Company’s consolidated financial position, results of operations, cash flows or disclosures.

Presentation of Financial Statements - Going Concern

In August 2014, the FASB issued an accounting standards update which requires management to assess

whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the entity’s

ability to continue as a going concern within one year after the financial statements are issued.€If substantial doubt

exists, additional disclosures are required. This update will be effective for the Company in the first quarter of 2017.

The adoption of the new standard is not expected to have a material impact on the Company’s consolidated financial

position, results of operations, cash flows or disclosures.

Revenue from Contracts with Customers

In May 2014, the FASB issued an accounting standards update which replaces the current revenue recognition

standards. The new revenue recognition standard provides a five-step analysis of transactions to determine when and

how revenue is recognized. The core principle is that a company should recognize revenue to depict the transfer of

promised goods or services to customers in an amount that reflects the consideration to which the entity expects to

be entitled in exchange for those goods or services. This standard was initially released as effective for fiscal years

beginning after December 15, 2016, however, the FASB has decided to defer the effective date of this accounting

standard update for one year. Early adoption of the update is permitted, but not before the original date for fiscal

years beginning after December 15, 2016. The update may be applied retrospectively for each period presented or as

a cumulative-effect adjustment at the date of adoption. The Company is evaluating the effect of adopting this new

standard.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

69