Sears 2015 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2015 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

On April 4, 2014, Holdings and Lands' End entered into a tax sharing agreement in connection with the spin-

off. Pursuant to this agreement, Holdings is responsible for all pre-separation U.S. federal, state and local income

taxes attributable to the Lands’ End business, and Lands’ End is responsible for all other income taxes attributable to

its business, including all foreign taxes.

In connection with the Sears Canada Rights Offering in fiscal 2014, the Company incurred a taxable gain of

approximately $107 million on the subscription rights exercised and common shares sold during the fiscal year.

There was no income tax payable balance resulting from the taxable gain due to the utilization of NOL attributes of

approximately $38 million and a valuation allowance release of the same amount. In addition, a foreign tax credit

carryover of $15 million was generated and the valuation allowance increased by the same amount.

In connection with Sears Canada’s sale of real estate during 2013, Sears Canada declared an extraordinary

dividend of $5 Canadian per share on November 19, 2013. The Company received a taxable dividend of $260

million Canadian or $243 million resulting in a taxable income inclusion of $280 million, which includes a Section

78 Gross-up of $37 million. The amount of taxes otherwise payable resulting from the taxable dividend was reduced

by the utilization of $59 million of net deferred tax assets, primarily NOL carryforwards. As the Company had

previously recorded a valuation allowance against these NOL carryforwards, $59 million of the related valuation

allowance was released upon their utilization.

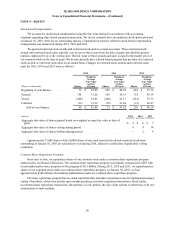

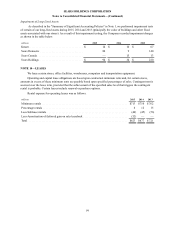

Accounting for Uncertainties in Income Taxes

We account for uncertainties in income taxes according to accounting standards for uncertain tax positions. We

are present in a large number of taxable jurisdictions, and at any point in time, can have audits underway at various

stages of completion in any of these jurisdictions. We evaluate our tax positions and establish liabilities for uncertain

tax positions that may be challenged by federal, foreign and/or local authorities and may not be fully sustained,

despite our belief that the underlying tax positions are fully supportable. Unrecognized tax benefits are reviewed on

an ongoing basis and are adjusted in light of changing facts and circumstances, including progress of tax audits,

developments in case law, and closing of statute of limitations. Such adjustments are reflected in the tax provision as

appropriate. While we do not expect material changes, it is possible that the amount of unrecognized benefit with

respect to our uncertain tax positions will significantly increase or decrease within the next 12 months related to the

audits described above. At this time, our estimated range of impact on the balance of unrecognized tax benefits for

2016 is a change of $2 million to $12 million, which would impact the effective tax rate by $1 million to $8 million.

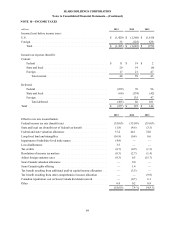

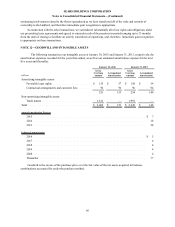

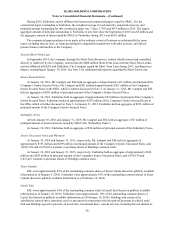

A€reconciliation of the beginning and ending amount of gross unrecognized tax benefits ("UTB") is as follows:

Federal,€State,€and€Foreign€Tax

millions

January 30,

2016

January 31,

2015

February 1,

2014

Gross UTB Balance at Beginning of Period . . . . . . . . . . . . . . . . . . . . . . . . . $131 $150 $161

Tax positions related to the current period:

Gross increases . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14 15 15

Gross decreases. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ———

Tax positions related to prior periods:

Gross increases . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ———

Gross decreases. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (27)(17)

Settlements. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (5)(1)

Lapse of statute of limitations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (8)(4)(6)

Exchange rate fluctuations. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 2 (2)

Gross UTB Balance at End of Period . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $137 $131 $150

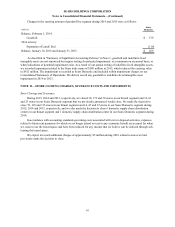

At the end of 2015, we had gross unrecognized tax benefits of $137 million. Of this amount, $89 million

would, if recognized, impact our effective tax rate, with the remaining amount being comprised of unrecognized tax

benefits related to indirect tax benefits. During fiscal year 2015, the gross unrecognized tax benefits increased by

$14 million due to current year accruals for existing tax positions. During fiscal year 2014, the gross unrecognized

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

92