Sears 2015 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2015 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

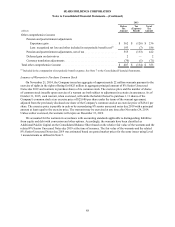

Seritage will be required to provide notice and make a lease termination payment to Holdings equal to the greater of

an amount specified in the Master Leases or an amount equal to 10 times the adjusted€earnings before interest, taxes,

depreciation, and amortization attributable to such space within the Holdings main store, which is not attributable to

the space subject to the separate 50% recapture right discussed above, for the 12-month period ending at the end of

the fiscal quarter ending immediately prior to recapturing such space. The Master Leases also provide Holdings

certain rights to terminate the Master Leases with respect to REIT properties or JV properties that cease to be

profitable for operation by Holdings. In order to terminate the Master Lease with respect to a certain property,

Holdings must make a payment to Seritage or the JV of an amount equal to one year of rent (together with taxes and

other expenses) with respect to such property. Such termination right, however, is limited so that it will not have the

effect of reducing the fixed rent under the Master Lease for the REIT properties by more than 20% per annum.

Also, in connection with the Seritage transaction and JV transactions, Holdings assigned its lease agreements

with third party tenants for REIT properties and JV properties to Seritage and each of the JVs, respectively, and also

assigned rental income from Lands' End for REIT properties and JV properties to Seritage and each of the JVs,

respectively.

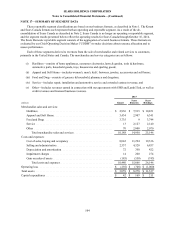

The initial amount of aggregate annual base rent under the Master Leases is $134 million for the REIT

properties and $42 million for the JV properties, with increases of 2% per year beginning in the second lease year

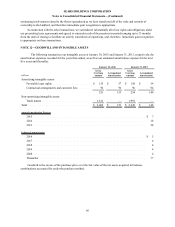

for the REIT properties and in the fourth lease year for the JV properties. Holdings recorded rent expense of $68

million in 2015 in cost of sales, buying and occupancy on the Consolidated Statement of Operations. Rent expense

consisted of straight-line rent expense offset by amortization of a deferred gain on sale-leaseback, as shown in the

table below.

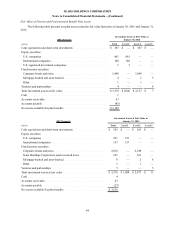

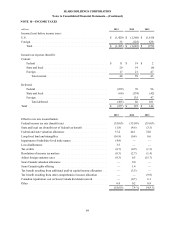

2015

millions Kmart

Sears

Domestic

Sears

Holdings

Straight-line rent expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $20 $100 $120

Amortization of deferred gain on sale-leaseback . . . . . . . . . . . . . . . . . . . . . . . . . . . (11)(41)(52)

Rent expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $9$59 $68

We accounted for the Seritage transaction and JV transactions in accordance with accounting standards

applicable to real estate sales and sale-leaseback transactions. We determined that the Seritage transaction qualifies

for sales recognition and sale-leaseback accounting. Because of our initial ownership interest in the JVs and

continuing involvement in the properties, we determined that the JV transactions, which occurred in the first quarter

of 2015, did not initially qualify for sale-leaseback accounting and, therefore, accounted for the JV transactions as

financing transactions and, accordingly, recorded a sale-leaseback financing obligation of $426 million and

continued to report the real property assets on our Condensed Consolidated Balance Sheets at May 2, 2015. Upon

the sale of our 50% interest in the JVs to Seritage, the continuing involvement through an ownership interest in the

buyer-lessor no longer existed, and Holdings determined that the JV transactions then qualified for sales recognition

and sale-leaseback accounting, with the exception of four properties for which we still have continuing involvement

as a result of an obligation to redevelop the stores for a third-party tenant and pay rent on behalf of the third-party

tenant until it commences rent payments to the JVs.

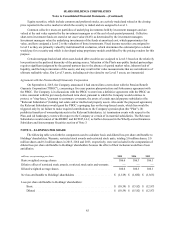

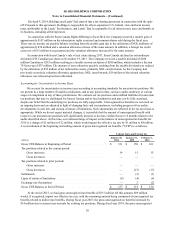

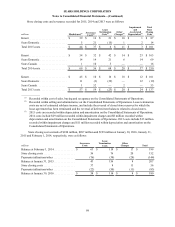

With the exception of the four properties that have continuing involvement, in accordance with accounting

standards related to sale-leaseback transactions, Holdings recognized any loss on sale immediately, any gain on sale

in excess of the present value of minimum lease payments immediately, and any remaining gain was deferred and

will be recognized in proportion to the related rent expense over the lease term. Holdings received aggregate net

proceeds of $3.1 billion for the Seritage transaction and JV transactions. The carrying amount of Property and

equipment, net and lease balances related to third-party leases that were assigned to Seritage and the JVs was $1.5

billion at July 7, 2015, of which $1.3 billion was recorded in our Sears Domestic segment and $175 million in our

Kmart segment. Accordingly, during the second quarter of 2015, Holdings recognized an immediate net gain of $508

million within gain on sales of assets on the Consolidated Statement of Operations for 2015, comprised of a gain for

the amount of gain on sale in excess of the present value of minimum lease payments, offset by a loss for properties

where the fair value was less than the carrying value and the write-off of lease balances related to third-party leases

that were assigned to Seritage and the JVs, as shown in the table below.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

94