Sears 2015 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2015 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

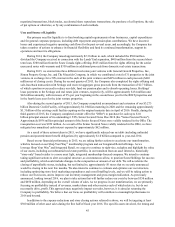

For 2015, net cash flows from investing activities primarily consisted of cash proceeds from the sale of

properties and investments of $2.7 billion, partially offset by cash used for capital expenditures of $211 million.

Proceeds from the sales of properties and investments included approximately $2.6 billion of net proceeds from the

Seritage transaction. For 2014, net cash flows generated from investing activities primarily consisted of cash

proceeds from the sale of properties and investments of $424 million, partially offset by cash used for capital

expenditures of $270 million. Additionally, 2014 included proceeds from the Sears Canada rights offering of $380

million, partially offset by $207 million resulting from the de-consolidation of Sears Canada cash. For 2013, net

cash flows generated from investing activities included cash proceeds from the sales of properties and investments

of $995 million, which were partially offset by cash used for capital expenditures of $329 million.

We spent $211 million, $270 million and $329 million during 2015, 2014 and 2013, respectively, for capital

expenditures. Capital expenditures during 2014 and 2013 included expenditures by Sears Canada of $32 million and

$70 million, respectively. Capital expenditures during all three years primarily included investments in online and

mobile shopping capabilities, enhancements to the Shop Your Way® platform, information technology infrastructure

and store maintenance.

We anticipate 2016 capital expenditure levels to be similar to 2015 levels. In the normal course of business,

we consider opportunities to purchase leased operating properties, as well as offers to sell owned, or assign leased,

operating and non-operating properties. These transactions may, individually or in the aggregate, result in material

proceeds or outlays of cash and cause our capital expenditure levels to vary from period to period. In addition, we

review leases that will expire in the short term in order to determine the appropriate action to take with respect to

them.

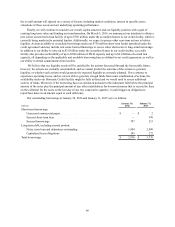

Financing Activities

During 2015, we used net cash flows in financing activities of $364 million, which consisted of debt

repayments of $1.4 billion, of which $927 million was the purchase of Senior Secured Notes pursuant to the tender

offer and $400 million was the repayment of the secured short-term loan, the payment of debt issuance costs of $50

million related to the amendment and extension of our Domestic Credit Facility and fees related to the tender offer

related to our Senior Secured Notes. These uses of cash were partially offset by an increase in short-term borrowings

of $583 million and $508 million of net cash proceeds from sale-leaseback financing, which consists of $426 million

of proceeds from the JV transactions received during the first quarter of 2015 and $82 million of proceeds from the

four joint venture properties that have continuing involvement received during the second quarter of 2015.

During 2014, the Company generated net cash from financing activities of $285 million, which primarily

consisted of Lands' End pre-separation funding of $515 million and proceeds from debt issuances of $1.0 billion,

consisting of $400 million from the secured short-term loan entered into in September 2014 and $625 million from

the 8% senior unsecured notes due 2019 issued in November 2014. For further information, see Note 3 of Notes to

Consolidated Financial Statements. The cash generated from financing activities were primarily used to pay down

existing revolver borrowings.

During 2013, the Company generated net cash from financing activities of $902 million, primarily due to

proceeds from debt issuances of $994 million, as well as an increase in short-term borrowings of $238 million,

which were partially offset by Sears Canada dividends paid to noncontrolling interests of $233 million. On October

2, 2013, the Company completed a new senior secured term loan facility of $1.0 billion under the Company's

existing Second Amended and Restated Credit agreement. The proceeds from the new term loan facility were used

to pay down existing revolver borrowings. During 2013, Sears Canada declared a cash dividend of $5 Canadian per

common share, or approximately $509 million Canadian ($476 million U.S.), which was paid on December 6, 2013.

Accordingly, the minority shareholders in Sears Canada received dividends of $233 million. For further information,

see Note 2 of Notes to Consolidated Financial Statements.

During 2015, 2014 and 2013, we did not repurchase any of our common shares under our share repurchase

program. The common share repurchase program was initially announced in 2005 and had a total authorization since

inception of the program of $6.5 billion. At January€30, 2016, we had approximately $504 million of remaining

authorization under the program. The common share repurchase program has no stated expiration date and share

repurchases may be implemented using a variety of methods, which may include open market purchases, privately

44