Sears 2015 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2015 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

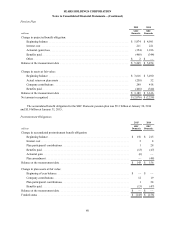

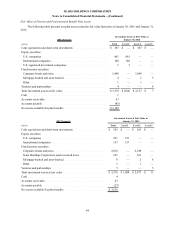

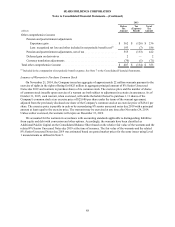

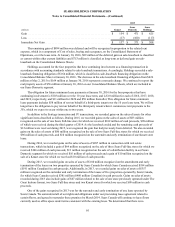

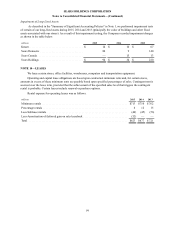

millions

January 30,

2016

January 31,

2015

Deferred tax assets and liabilities:

Deferred tax assets:

Federal benefit for state and foreign taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $147 $146

Accruals and other liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 180 166

Capital leases . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 54 64

NOL carryforwards . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,583 1,843

Postretirement benefit plans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 86 92

Pension . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,241 1,207

Property and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 226 74

Deferred income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 514 128

Credit carryforwards . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 832 791

Other. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 164 124

Total deferred tax assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,027 4,635

Valuation allowance. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (4,757)(4,478)

Net deferred tax assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 270 157

Deferred tax liabilities:

Trade names/Intangibles. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 722 791

Inventory . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 338 440

Other. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 103 121

Total deferred tax liabilities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,163 1,352

Net deferred tax liability . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(893) $ (1,195)

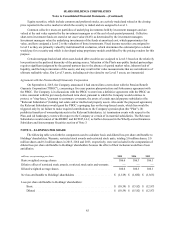

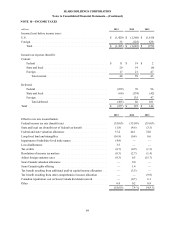

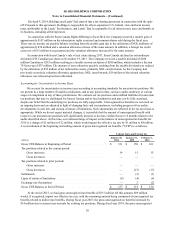

Income tax expense or benefit from continuing operations is generally determined without regard to other

categories of earnings, such as discontinued operations and other comprehensive income ("OCI"). An exception is

provided in the authoritative accounting guidance when there is income from categories other than continuing

operations and a loss from continuing operations in the current year. In this case, the tax benefit allocated to

continuing operations is the amount by which the loss from continuing operations reduces the tax expense recorded

with respect to the other categories of earnings, even when a valuation allowance has been established against the

deferred tax assets. In instances where a valuation allowance is established against current year losses, income from

other sources, including gain from pension and other postretirement benefits recorded as a component of OCI and

creation of a deferred tax liability through additional paid in capital, is considered when determining whether

sufficient future taxable income exists to realize the deferred tax assets. As a result, for the tax year ended January

31, 2015, the Company recorded a charge of $59 million through additional paid in capital relating to the book to tax

difference for the original issue discount ("OID") relating to the Senior Unsecured Notes, and recorded a valuation

allowance reversal of $59 million in continuing operations. For the tax year ended February 1, 2014, the Company

recorded a tax expense of $97 million in OCI related to the gain on pension and other postretirement benefits, and

recorded a corresponding tax benefit of $97 million in continuing operations.

We account for income taxes in accordance with accounting standards for income taxes, which requires that

deferred tax assets and liabilities be recognized using enacted tax rates for the effect of temporary differences

between the financial reporting and tax bases of recorded assets and liabilities. Accounting standards also require

that deferred tax assets be reduced by a valuation allowance if it is more likely than not that some portion of or all of

the deferred tax asset will not be realized.

Management assesses the available positive and negative evidence to estimate if sufficient future taxable

income will be generated to use the existing deferred tax assets. A significant piece of objective negative evidence

evaluated was the cumulative loss incurred over the three-year periods ended January 30, 2016, January€31, 2015,

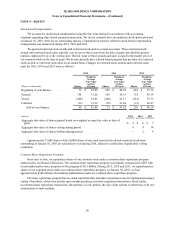

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

90