Sears 2015 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2015 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

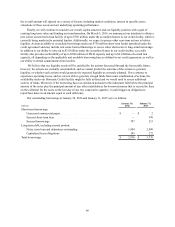

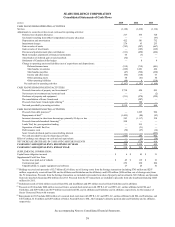

For purposes of determining the periodic expense of our defined benefit plan, we use the fair value of plan

assets as the market related value. A one-percentage-point change in the assumed discount rate would have the

following effects on the pension liability:

millions

1€percentage-point

Increase

1€percentage-point

Decrease

Effect on interest cost component. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 23 $ (30)

Effect on pension benefit obligation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (498) $ 596

Income Taxes

We account for income taxes according to accounting standards for such taxes. Deferred tax assets and

liabilities are recognized for the future tax consequences attributable to differences between the book basis and tax

basis of assets and liabilities. Deferred tax assets and liabilities are measured using enacted tax rates expected to

apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. If

future utilization of deferred tax assets is uncertain, the Company may record a valuation allowance against its

deferred tax assets. Our accounting policies related to the valuation allowance are further described in Note 1 of

Notes to Consolidated Financial Statements. After consideration of evidence regarding the ability to realize our

deferred tax assets, we established a valuation allowance against deferred income tax assets in 2015, 2014, and

2013. For the year ended January 30, 2016, the valuation allowance increased by $279 million of which $63 million

was recorded through other comprehensive income and paid in capital. The Company continues to monitor its

operating performance and evaluate the likelihood of the future realization of these deferred tax assets.

Significant management judgment is required in determining our provision for income taxes, deferred tax

assets and liabilities and the valuation allowance recorded against our net deferred tax assets, if any. Management

considers estimates of the amount and character of future taxable income in assessing the likelihood of realization of

deferred tax assets. Our actual effective tax rate and income tax expense could vary from estimated amounts due to

the future impacts of various items, including changes in income tax laws, tax planning and the Company's

forecasted financial condition and results of operations in future periods. Although management believes current

estimates are reasonable, actual results could differ from these estimates.

Domestic and foreign tax authorities periodically audit our income tax returns. These audits include questions

regarding our tax filing positions, including the timing and amount of deductions and the allocation of income

among various tax jurisdictions. In evaluating the exposures associated with our various tax filing positions, we

record reserves in accordance with accounting standards for uncertain tax positions. A number of years may elapse

before a particular matter, for which we have established a reserve, is audited and fully resolved. Management's

estimates at the date of the financial statements reflect our best judgment, giving consideration to all currently

available facts and circumstances. As such, these estimates may require adjustment in the future, as additional facts

become known or as circumstances change. For further information, see Note 10 of Notes to Consolidated Financial

Statements.

Goodwill and Intangible Asset Impairment Assessments

At both January€30, 2016 and January€31, 2015, we had goodwill balances of $269 million, and intangible

asset balances of $1.9 billion and $2.1 billion, respectively. The Company evaluates the carrying value of goodwill

and intangible assets for possible impairment under accounting standards governing goodwill and other intangible

assets. Our accounting policies related to goodwill and intangible asset impairment assessments are further described

in Note 1 of Notes to Consolidated Financial Statements.

Goodwill Impairment Assessments

Our goodwill balance relates to our Home Services business. We did not record any goodwill impairment

charges in 2015, 2014 or 2013.

The use of different assumptions, estimates or judgments in either step of the goodwill impairment testing

process, such as the estimated future cash flows of the reporting unit, the discount rate used to discount such cash

51