Sears 2015 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2015 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

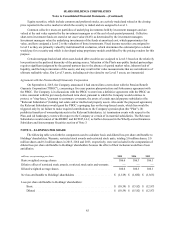

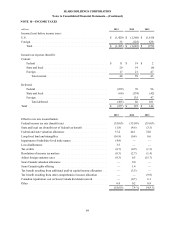

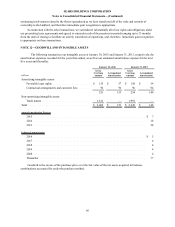

tax benefits decreased by $25 million due to the Lands’ End spin-off and Sears Canada’s de-consolidation. We

expect that our unrecognized tax benefits could decrease up to $6 million over the next 12 months for tax audit

settlements and the expiration of the statute of limitations for certain jurisdictions.

We classify interest expense and penalties related to unrecognized tax benefits and interest income on tax

overpayments as components of income tax expense. At January 30, 2016 and January€31, 2015, the total amount of

interest and penalties recognized within the related tax liability in our Consolidated Balance Sheet was $56 million

($36 million net of federal benefit) and $49 million ($32 million net of federal benefit), respectively. The total

amount of net interest expense recognized in our Consolidated Statement of Operations for 2015, 2014 and 2013

was $4 million, $4 million and $2 million, respectively.

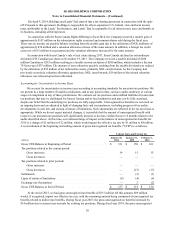

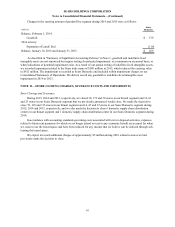

We file income tax returns in both the United States and various foreign jurisdictions. The U.S. Internal

Revenue Service (“IRS”) has completed its examination of all federal tax returns of Holdings through the 2009

return, and all matters arising from such examinations have been resolved. In addition, Holdings and Sears are under

examination by various state, local and foreign income tax jurisdictions for the years 2003 through 2013, and Kmart

is under examination by such jurisdictions for the years 2006 through 2013.

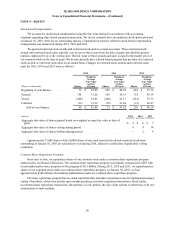

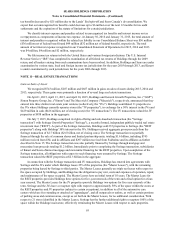

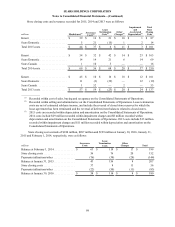

NOTE 11—REAL ESTATE TRANSACTIONS

Gain on Sales of Assets

We recognized $743 million, $207 million and $667 million in gains on sales of assets during 2015, 2014 and

2013, respectively. These gains were primarily a function of several large real estate transactions.

On April 1, 2015, April 13, 2015, and April 30, 2015, Holdings and General Growth Properties, Inc. ("GGP"),

Simon Property Group, Inc. ("Simon") and The Macerich Company ("Macerich"), respectively, announced that they

entered into three distinct real estate joint ventures (collectively, the "JVs"). Holdings contributed 31 properties to

the JVs where Holdings currently operates stores (the "JV properties"), in exchange for a 50% interest in the JVs and

$429 million in cash ($426 million, net of closing costs) (the "JV transactions"). The JV transactions valued the JV

properties at $858 million in the aggregate.

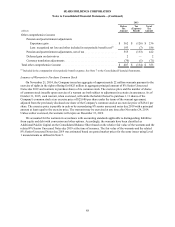

On July 7, 2015, Holdings completed its rights offering and sale-leaseback transaction (the "Seritage

transaction") with Seritage Growth Properties ("Seritage"), a recently formed, independent publicly traded real estate

investment trust ("REIT"). As part of the Seritage transaction, Holdings sold 235 properties to Seritage (the "REIT

properties") along with Holdings' 50% interest in the JVs. Holdings received aggregate gross proceeds from the

Seritage transaction of $2.7 billion ($2.6 billion, net of closing costs). The Seritage transaction was partially

financed through the sale of common shares and limited partnership units, totaling $1.6 billion, including $745

million received from ESL and its affiliates and $297 million received from Fairholme and its affiliates as further

described in Note 15. The Seritage transaction was also partially financed by Seritage through mortgage and

mezzanine loan proceeds totaling $1.2 billion. Immediately prior to completing the Seritage transaction, subsidiaries

of Kmart and Sears obtained mortgage and mezzanine financing for the REIT properties. Upon completion of the

Seritage transaction, all obligations with respect to such financing were assumed by Seritage. The Seritage

transaction valued the REIT properties at $2.3 billion in the aggregate.

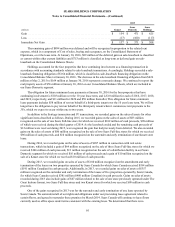

In connection with the Seritage transaction and JV transactions, Holdings has entered into agreements with

Seritage and the JVs under which Holdings leases 255 of the properties (the "Master Leases"), with the remaining

properties being leased by Seritage to third parties. The Master Leases generally are triple net leases with respect to

the space occupied by Holdings, and Holdings has the obligation to pay rent, costs and expenses of operation, repair,

and maintenance of the space occupied. The Master Leases have an initial term of 10 years. The Master Lease for

the REIT properties provides Holdings three options for five-year renewals of the term and a final option for a four-

year renewal. The Master Leases for the JV properties provide Holdings two options for five-year renewals of the

term. Seritage and the JVs have a recapture right with respect to approximately 50% of the space within the stores at

the REIT properties and JV properties (subject to certain exceptions), in addition to all of the automotive care

centers which are free-standing or attached as "appendages", and all outparcels or outlots, as well as certain portions

of parking areas and common areas, except as set forth in the Master Leases, for no additional consideration. With

respect to 21 stores identified in the Master Leases, Seritage has the further additional right to recapture 100% of the

space within the Holdings' main store, effectively terminating the Master Leases with respect to such properties.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

93