Sears 2015 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2015 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

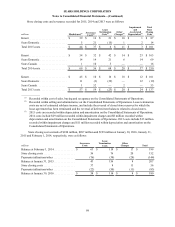

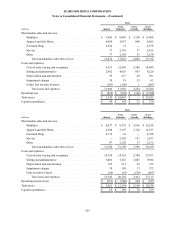

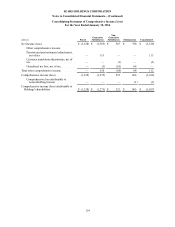

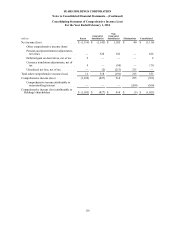

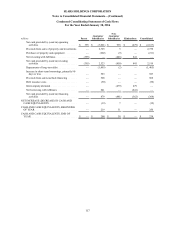

On October 16, 2014, we de-consolidated Sears Canada pursuant to a rights offering transaction. The

following condensed consolidated financial statements had total assets and liabilities of approximately $2.2 billion

and $1.3 billion, respectively, at February 1, 2014, attributable to Sears Canada. Merchandise sales and services

included revenues of approximately $2.1 billion and $3.8 billion in 2014 and 2013, respectively. Net loss

attributable to Holdings' shareholders included net loss of approximately $137 million in 2014 and net income of

approximately $244 million in 2013. The financial information for Sears Canada is reflected within the non-

guarantor subsidiaries balances for these periods.

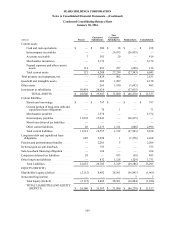

The principal elimination entries relate to investments in subsidiaries and intercompany balances and

transactions including transactions with our wholly-owned non-guarantor insurance subsidiary. The Company has

accounted for investments in subsidiaries under the equity method. The guarantor subsidiaries are 100% owned

directly or indirectly by the Parent and all guarantees are joint, several and unconditional. Additionally, the notes are

secured by a security interest in certain assets consisting primarily of domestic inventory and credit card receivables

of the guarantor subsidiaries, and consequently may not be available to satisfy the claims of the Company’s general

creditors. Certain investments primarily held by non-guarantor subsidiaries are recorded by the issuers at historical

cost and are recorded at fair value by the holder.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

108