Sears 2015 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2015 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the overall amount will depend on a variety of factors, including market conditions, interest in specific assets,

valuations of those assets and our underlying operating performance.

Finally, we will continue to consider our overall capital structure and our liquidity position with a goal of

creating long-term value and funding our transformation. On March 3, 2016, we announced our intention to obtain a

new senior secured term loan facility of up to $750 million under the accordion feature in our credit facility, which is

currently being marketed to potential lenders. Additionally, we expect to pursue other near-term actions to bolster

liquidity. Actions available to us include borrowings under our $750 million short-term basket permitted under the

credit agreement and may include real estate backed financings to secure either short-term or long-term borrowings.

In addition to our ability to raise up to $1.0 billion under the accordion feature in our credit facility, our credit

facility also provides us flexibility of up to $500 million of FILO capacity and up to $2.0 billion of second lien

capacity, all depending on the applicable and available borrowing base as defined in our credit agreement, as well as

our ability to obtain commitments from lenders.

We believe that our liquidity needs will be satisfied by the actions discussed through the foreseeable future;

however, the actions are currently uncommitted, and we cannot predict the outcome of the actions to generate

liquidity, or whether such actions would generate the expected liquidity as currently planned. If we continue to

experience operating losses, and we are not able to generate enough funds from some combination of actions, the

availability under our Domestic Credit Facility might be fully utilized and we would need to secure additional

sources of funds.€Moreover, if the borrowing base (as calculated pursuant to the indenture) falls below the principal

amount of the notes plus the principal amount of any other indebtedness for borrowed money that is secured by liens

on the collateral for the notes on the last day of any two consecutive quarters, it could trigger an obligation to

repurchase notes in an amount equal to such deficiency.

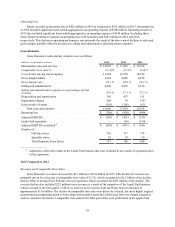

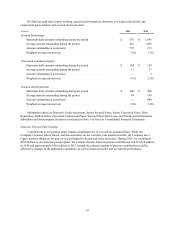

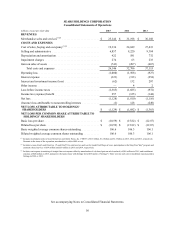

Our outstanding borrowings at January€30, 2016 and January€31, 2015 were as follows:

millions

January 30,

2016

January 31,

2015

Short-term borrowings:

Unsecured commercial paper . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ — $ 2

Secured short-term loan. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 399

Secured borrowings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 797 213

Long-term debt, including current portion:

Notes, term loan and debentures outstanding . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,984 2,890

Capitalized lease obligations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 195 272

Total borrowings. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,976 $ 3,776

46