Sears 2015 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2015 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

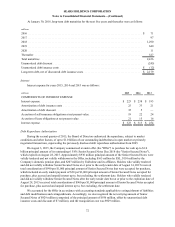

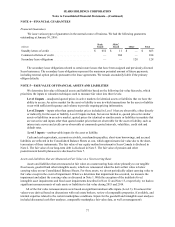

NOTE 4—FINANCIAL GUARANTEES

Financial Guarantees

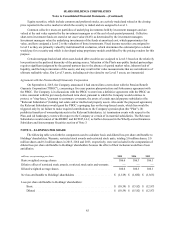

We issue various types of guarantees in the normal course of business. We had the following guarantees

outstanding at January€30, 2016:

millions

Bank

Issued

SRAC

Issued Other Total

Standby letters of credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $652 $11 $—$663

Commercial letters of credit . . . . . . . . . . . . . . . . . . . . . . . . . . — 104 — 104

Secondary lease obligations . . . . . . . . . . . . . . . . . . . . . . . . . . — — 128 128

The secondary lease obligations related to certain store leases that have been assigned and previously divested

Sears businesses. The secondary lease obligations represent the maximum potential amount of future payments,

including renewal option periods pursuant to the lease agreements. We remain secondarily liable if the primary

obligor defaults.

NOTE 5—FAIR VALUE OF FINANCIAL ASSETS AND LIABILITIES

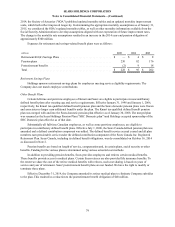

We determine fair value of financial assets and liabilities based on the following fair value hierarchy, which

prioritizes the inputs to valuation techniques used to measure fair value into three levels:

Level 1 inputs – unadjusted quoted prices in active markets for identical assets or liabilities that we have the

ability to access. An active market for the asset or liability is one in which transactions for the asset or liability

occur with sufficient frequency and volume to provide ongoing pricing information.

Level 2 inputs – inputs other than quoted market prices included in Level 1 that are observable, either directly

or indirectly, for the asset or liability. Level 2 inputs include, but are not limited to, quoted prices for similar

assets or liabilities in an active market, quoted prices for identical or similar assets or liabilities in markets that

are not active and inputs other than quoted market prices that are observable for the asset or liability, such as

interest rate curves and yield curves observable at commonly quoted intervals, volatilities, credit risk and

default rates.

Level 3 inputs – unobservable inputs for the asset or liability.

Cash and cash equivalents, accounts receivable, merchandise payables, short-term borrowings, and accrued

liabilities are reflected in the Consolidated Balance Sheets at cost, which approximates fair value due to the short-

term nature of these instruments. The fair value of our equity method investment in Sears Canada is disclosed in

Note 2. The fair value of our long-term debt is disclosed in Note 3. The fair value of pension and other

postretirement benefit plan assets is disclosed in Note 7.

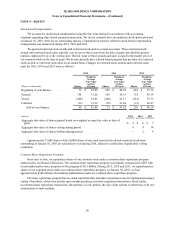

Assets and Liabilities that are Measured at Fair Value on a Nonrecurring Basis

Assets and liabilities that are measured at fair value on a nonrecurring basis relate primarily to our tangible

fixed assets, goodwill and other intangible assets, which are remeasured when the derived fair value is below

carrying value on our Consolidated Balance Sheets. For these assets, we do not periodically adjust carrying value to

fair value except in the event of impairment. When we determine that impairment has occurred, we measure the

impairment and adjust the carrying value as discussed in Note 1. With the exception of the indefinite-lived

intangible asset impairments and fixed asset impairments described in Note 12 and Note 13, respectively, we had no

significant remeasurements of such assets or liabilities to fair value during 2015 and 2014.

All of the fair value remeasurements were based on significant unobservable inputs (Level 3). Fixed asset fair

values were derived based on discussions with real estate brokers, review of comparable properties, if available, and

internal expertise related to the current marketplace conditions. Inputs for the goodwill and intangible asset analyses

included discounted cash flow analyses, comparable marketplace fair value data, as well as management's

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

77