Sears 2015 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2015 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

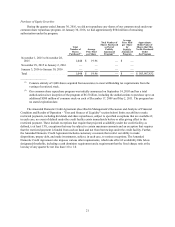

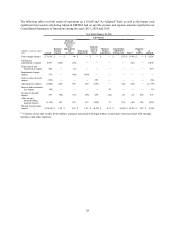

In accordance with GAAP, we recognize on the balance sheet actuarial gains and losses for defined

benefit pension plans annually in the fourth quarter of each fiscal year and whenever a plan is determined

to qualify for a remeasurement during a fiscal year.€For income statement purposes, these actuarial gains

and losses are recognized throughout the year through an amortization process. The Company recognizes in

its results of operations, as a corridor adjustment, any unrecognized actuarial net gains or losses that exceed

10% of the larger of projected benefit obligations or plan assets. Accumulated gains/losses that are inside

the 10% corridor are not recognized, while accumulated actuarial gains/losses that are outside the 10%

corridor are amortized over the "average future service" of the population and are included in the

amortization of experience losses line item above.

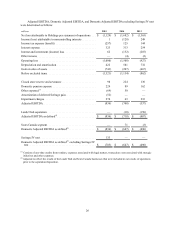

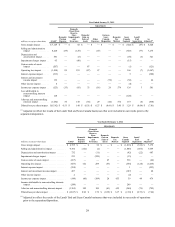

Actuarial gains and losses occur when actual experience differs from the estimates used to allocate

the change in value of pension plans to expense throughout the year or when assumptions change, as they

may each year. Significant factors that can contribute to the recognition of actuarial gains and losses

include changes in discount rates used to remeasure pension obligations on an annual basis or upon a

qualifying remeasurement, differences between actual and expected returns on plan assets and other

changes in actuarial assumptions. Management believes these actuarial gains and losses are primarily

financing activities that are more reflective of changes in current conditions in global financial markets

(and in particular interest rates) that are not directly related to the underlying business and that do not have

an immediate, corresponding impact on the benefits provided to eligible retirees. For further information on

the actuarial assumptions and plan assets referenced above, see Management's Discussion and Analysis of

Financial Condition and Results of Operations - Application of Critical Accounting Policies and Estimates -

Defined Benefit Pension Plans, and Note 7 of Notes to Consolidated Financial Statements.

• Closed store reserve and severance – We are transforming our Company to a less asset-intensive business

model. Throughout this transformation, we continue to make choices related to our stores, which could

result in sales, closures, lease terminations or a variety of other decisions.

• Impairment charges – Accounting standards require the Company to evaluate the carrying value of fixed

assets, goodwill and intangible assets for impairment. As a result of the Company's analysis, we have

recorded impairment charges related to certain fixed asset and indefinite-lived intangible asset balances.

• Domestic gains on sales of assets – We have recorded significant gains on sales of assets, as well as gains

on sales of joint venture interests, which were primarily attributable to several real estate transactions.

Management considers these gains on sale of assets to result from investing decisions rather than ongoing

operations.

• Mark-to-market adjustments – We elected the fair value option for the equity method investment in Sears

Canada, and the change in fair value is recorded in interest and investment income on the Consolidated

Statement of Operations. Management considers activity related to our retained investment in Sears Canada

to result from investing decisions rather than ongoing operations. Furthermore, we do not consider the short

term fluctuations in Sears Canada's stock price useful in assessing our operating performance.

• Amortization of deferred Seritage gain – A portion of the gain on the Seritage transaction was deferred and

will be recognized in proportion to the related rent expense, which is a component of cost of sales, buying

and occupancy on the Consolidated Statement of Operations, over the lease term. Management considers

the amortization of the deferred Seritage gain to result from investing decisions rather than ongoing

operations.

• Other – consists of one-time credits from vendors, transaction costs associated with strategic initiatives,

expenses associated with legal matters and other expenses.

• Domestic tax matters – In 2011, we recorded a non-cash charge to establish a valuation allowance against

substantially all of our domestic deferred tax assets. Accounting rules generally require that a valuation

reserve be established when income has not been generated over a three-year cumulative period to support

the deferred tax asset. While an accounting loss was recorded, we believe no economic loss has occurred as

these net operating losses and tax benefits remain available to reduce future taxes as income is generated in

subsequent periods. As this valuation allowance has a significant impact on the effective tax rate, we have

31