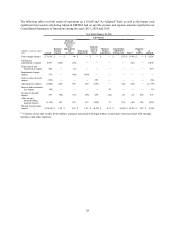

Sears 2015 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2015 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

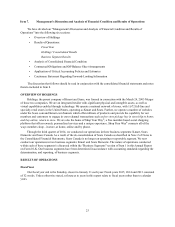

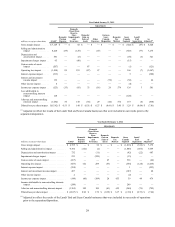

Selling and Administrative Expenses

Selling and administrative expenses decreased $1.4 billion to $6.9 billion in 2015 from $8.2 billion in 2014

and included significant items which aggregated to expense of $365 million and $945 million for 2015 and 2014,

respectively, with 2014 including expenses of $603 million from Sears Canada and $77 million from the Lands' End

business. Excluding these items, selling and administrative expenses declined $783 million, primarily due to

decreases in payroll and advertising expenses.

Selling and administrative expenses as a percentage of revenues ("selling and administrative expense rate")

were 27.3% and 26.3% for 2015 and 2014, respectively, as the decreases in overall selling and administrative

expenses were more than offset by the above noted decline in revenues.

Depreciation and Amortization

Depreciation and amortization expense decreased by $159 million during 2015 to $422 million, primarily due

to having fewer assets to depreciate. Depreciation and amortization expense during 2014 included expense of $52

million related to Sears Canada and the Lands' End business.

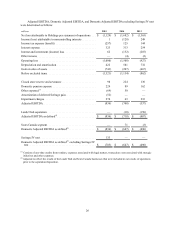

Impairment Charges

We recorded impairment charges of $274 million in 2015, which consisted of impairment of $180 million

related to the Sears trade name, as well as $94 million related to the impairment of long-lived assets. We recorded

impairment charges of $63 million in 2014, which were related to the impairment of long-lived assets. Impairment

charges recorded in both years are described further in Notes 1 and 13 of Notes to Consolidated Financial

Statements.

Gain on Sales of Assets

We recorded total gains on sales of assets of $743 million in 2015 and $207 million in 2014, which were

primarily attributable to several significant real estate transactions. The gains recorded in 2015 included $508

million recognized in connection with the joint venture transactions and the sale-leaseback transaction with Seritage.

Gains on sales of assets recorded in both years are described further in Note 11 of Notes to Consolidated Financial

Statements.

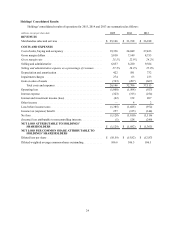

Operating Loss

We recorded an operating loss of $1.0 billion and $1.5 billion in 2015 and 2014, respectively. The operating

loss for 2015 included significant items which aggregated to operating income of $199 million, while operating loss

for 2014 included significant items which aggregated to operating expense of $461 million. Excluding these items,

we would have reported an operating loss of $1.2 billion and $1.0 billion in 2015 and 2014, respectively. The

increase in operating loss in 2015 was primarily driven by the decrease in gross margin, partially offset by the

decline in selling and administrative expenses.

Interest Expense

We incurred $323 million and $313 million in interest expense during 2015 and 2014, respectively. The

increase is due to an increase in average outstanding borrowings in 2015.

Interest and Investment Income (Loss)

We recorded interest and investment loss of $62 million during 2015 compared to interest and investment

income of $132 million during 2014. Interest and investment income (loss) is described further in Note 6 of Notes to

Consolidated Financial Statements.

Income Taxes

We recorded an income tax benefit of $257 million in 2015 compared with income tax expense of $125

million in 2014. During 2015, the Company realized a significant tax benefit on the deferred taxes related to

33