Sears 2015 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2015 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

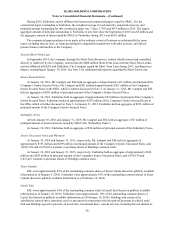

Seritage

ESL owns approximately 9.8% of the total voting power of Seritage, and approximately 43.5% of the limited

partnership units of Seritage Growth Properties, L.P. (the “Operating Partnership”), the entity that now owns the

properties sold by the Company in the Seritage transaction and through which Seritage conducts its operations

(based on publicly available information as of August 14, 2015). Mr. Lampert is also currently the Chairman of the

Board of Trustees of Seritage. Fairholme owns approximately 14% of the outstanding Class A common shares of

Seritage and 100% of the outstanding Class C non-voting common shares of Seritage (based on publicly available

information as of February 16, 2016).

In connection with the Seritage transaction as described in Note 11, Holdings entered into a Master Lease

agreement with Seritage. The initial amount of aggregate annual base rent under the Master Lease is $134 million

for the REIT properties, with increases of 2% per year beginning in the second lease year. Holdings recorded rent

expense of $49 million in Cost of sales, buying and occupancy for 2015. Rent expense consists of straight-line rent

expense of $84 million, offset by amortization of a deferred gain recognized pursuant to the sale and leaseback of

properties from Seritage of $35 million for 2015.

In addition to base rent under the Master Lease, Holdings pays monthly installment expenses for property

taxes and insurance at all REIT properties where Holdings is a tenant and installment expenses for common area

maintenance, utilities and other operating expenses at REIT properties that are multi-tenant locations where

Holdings and other third parties are tenants. The initial amount of aggregate installment expenses under the Master

Lease is $70 million, based on estimated installment expenses, and will be reconciled annually based on actual

installment expenses. Holdings paid $40 million for 2015, recorded in Cost of sales, buying and occupancy.

Holdings and Seritage entered into a transition services agreement pursuant to which Holdings will provide

certain limited services to Seritage for up to 18 months. The services include specified facilities management,

accounting, treasury, tax, information technology, risk management, human resources, and related support services.

Under the terms of the transition services agreement, the scope and level of the facilities management services will

be substantially consistent with the scope and level of the services provided in connection with the operation of the

transferred properties held by Holdings prior to the closing of the Seritage transaction. Amounts due from Seritage

are generally settled on a net basis. Holdings invoices Seritage on at least a monthly basis. Revenues recognized

related to the transition services agreement were not material for 2015. At January 30, 2016, Holdings reported a net

amount receivable from Seritage of $7 million in the accounts receivable line of the Condensed Consolidated

Balance Sheets.

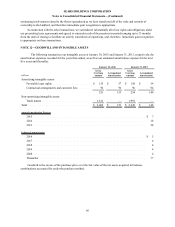

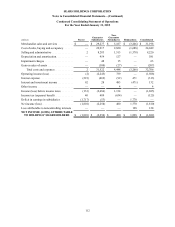

NOTE€16—SUPPLEMENTAL FINANCIAL INFORMATION

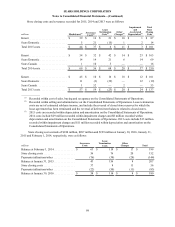

Other long-term liabilities at January€30, 2016 and€January€31, 2015 consisted of the following:€

millions

January 30,

2016

January 31,

2015

Unearned revenues. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $694 $739

Self-insurance reserves . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 567 611

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 470 499

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,731 $1,849

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

103