Sears 2015 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2015 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

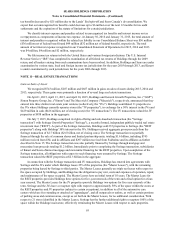

Equity securities, which include common and preferred stocks, are actively traded and valued at the closing

price reported in the active market in which the security is traded and are assigned to Level 1.

Common collective trusts are portfolios of underlying investments held by investment managers and are

valued at the unit value reported by the investment managers as of the end of each period presented. Collective

short-term investment funds are stated at net asset value (NAV) as determined by the investment managers.

Investment managers value the underlying investments of the funds at amortized cost, which approximates fair

value, and have assigned a Level 2 to the valuation of those investments. Fixed income securities are assigned to

Level 2 as they are primarily valued by institutional bid evaluation, which determines the estimated price a dealer

would pay for a security and which is developed using proprietary models established by the pricing vendors for this

purpose.

Certain mortgage-backed and other asset-backed debt securities are assigned to Level 3 based on the relatively

low position in the preferred hierarchy of the pricing source. Valuation of the Plan's non-public limited partnerships

requires significant judgment by the general partners due to the absence of quoted market value, inherent lack of

liquidity, and the long-term nature of the assets, and may result in fair value measurements that are not indicative of

ultimate realizable value. Our Level 3 assets, including activity related to our Level 3 assets, are immaterial.

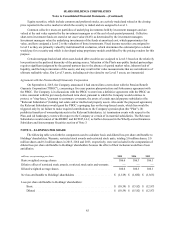

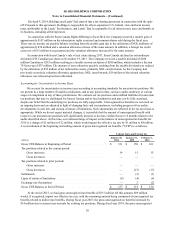

Agreement with the Pension Benefit Guaranty Corporation

On September 4, 2015, the Company announced it had entered into a term sheet with the Pension Benefit

Guaranty Corporation ("PBGC"), concerning a five-year pension plan protection and forbearance agreement with

the PBGC. The Company is in discussions with the PBGC to enter into a definitive agreement with the PBGC on

terms consistent with the previously disclosed term sheet, pursuant to which the Company would continue to

protect, or "ring-fence," pursuant to customary covenants, the assets of certain special purpose subsidiaries (the

"Relevant Subsidiaries") holding real estate and/or intellectual property assets. Also under the proposed agreement,

the Relevant Subsidiaries would grant the PBGC a springing lien on the ring-fenced assets, which lien would be

triggered only by (a) failure to make required contributions to the Company's pension plan (the "Plan"), (b)

prohibited transfers of ownership interests in the Relevant Subsidiaries, (c) termination events with respect to the

Plan, and (d) bankruptcy events with respect to the Company or certain of its material subsidiaries. The Relevant

Subsidiaries would consist of the REMIC and KCD IP, LLC, as further discussed in the Wholly-owned Insurance

Subsidiary and Intercompany Securities section of Note 3.€

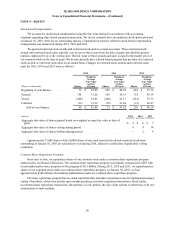

NOTE 8—EARNINGS PER SHARE

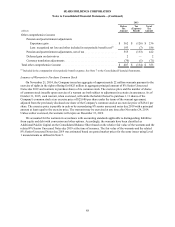

The following table sets forth the components used to calculate basic and diluted loss per share attributable to

Holdings' shareholders. Warrants, restricted stock awards and restricted stock units, totaling 5.0 million shares, 5.0

million shares and 0.2 million shares in 2015, 2014 and 2013, respectively, were not included in the computation of

diluted loss per share attributable to Holdings' shareholders because the effect of their inclusion would have been

antidilutive.

millions, except earnings per share 2015 2014 2013

Basic weighted average shares. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 106.6 106.3 106.1

Dilutive effect of restricted stock awards, restricted stock units and warrants . . ———

Diluted weighted average shares . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 106.6 106.3 106.1

Net loss attributable to Holdings' shareholders . . . . . . . . . . . . . . . . . . . . . . . . . . $(1,129) $ (1,682) $ (1,365)

Loss per share attributable to Holdings' shareholders:

Basic . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(10.59) $ (15.82) $ (12.87)

Diluted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(10.59) $ (15.82) $ (12.87)

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

85