Sears 2015 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2015 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

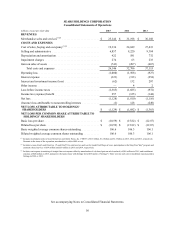

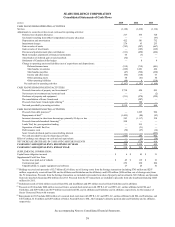

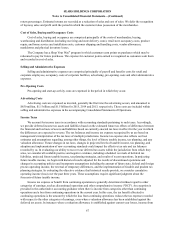

SEARS HOLDINGS CORPORATION

Consolidated Statements of Cash Flows

millions 2015 2014 2013

CASH FLOWS FROM OPERATING ACTIVITIES

Net loss. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(1,128)

(1,810)

(1,116)

Adjustments to reconcile net loss to net cash used in operating activities:

Deferred tax valuation allowance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

217

835

720

Tax benefit resulting from Other Comprehensive Income allocation. . . . . . . . . . . . . . . . . . . . . . . . . .

—

—

(97)

Depreciation and amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

422

581

732

Impairment charges. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

274

63

233

Gain on sales of assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(743)

(207)

(667)

Gain on sales of investments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

—

(105)

(169)

Pension and postretirement plan contributions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(311)

(450)

(426)

Mark-to-market adjustments of financial instruments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

66

(3)

—

Amortization of deferred gain on sale-leaseback . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(52)

—

—

Settlement of Canadian dollar hedges. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

—

8

9

Change in operating assets and liabilities (net of acquisitions and dispositions):

Deferred income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(519)

(719)

(441)

Merchandise inventories . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(229)

1,091

446

Merchandise payables . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(47)

(528)

(230)

Income and other taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(95)

(110)

63

Other operating assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

68

(41)

44

Other operating liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(90)

8

(210)

Net cash used in operating activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(2,167)

(1,387)

(1,109)

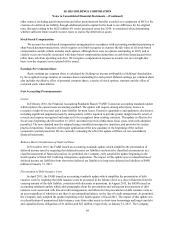

CASH FLOWS FROM INVESTING ACTIVITIES

Proceeds from sales of property and investments(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,730 424 995

Net increase in investments and restricted cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

—

—

(2)

Purchases of property and equipment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(211)

(270)

(329)

De-consolidation of Sears Canada cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

—

(207)

—

Proceeds from Sears Canada rights offering(2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 380 —

Net cash provided by investing activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2,519

327

664

CASH FLOWS FROM FINANCING ACTIVITIES

Proceeds from debt issuances(3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 1,025 994

Repayments of debt(4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,405) (80) (83)

Increase (decrease) in short-term borrowings, primarily 90 days or less . . . . . . . . . . . . . . . . . . . . . . .

583

(1,117)

238

Proceeds from sale-leaseback financing(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 508 — —

Lands' End, Inc. pre-separation funding . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

—

515

—

Separation of Lands' End, Inc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

—

(31)

—

Debt issuance costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(50)

(27)

(14)

Sears Canada dividends paid to noncontrolling interests . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

—

—

(233)

Net cash provided by (used in) financing activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(364)

285

902

Effect of exchange rate changes on cash and cash equivalents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

—

(3)

(38)

NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS. . . . . . . . . . . . . . . . . . . . . . . . .

(12)

(778)

419

CASH AND CASH EQUIVALENTS, BEGINNING OF YEAR . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

250

1,028

609

CASH AND CASH EQUIVALENTS, END OF YEAR . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 238 $ 250 $ 1,028

SUPPLEMENTAL INFORMATION:

Capital lease obligation incurred . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ 6

$ 45

$ 31

Supplemental Cash Flow Data:

Income taxes paid, net of refunds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ 45

$ 119

$ 21

Cash interest paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

252

230

206

Unpaid liability to acquire equipment and software. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27

25

41

(1) Holdings received cash proceeds of $2.7 billion ($2.6 billion, net of closing costs) from the Seritage transaction (including $745 million and $297

million, respectively, received from ESL and its affiliates and Fairholme and its affiliates), and $429 million ($426 million, net of closing costs) from

the JV transactions. Proceeds from the Seritage transaction are included in proceeds from sales of property and investments ($2.6 billion), and proceeds

from sale-leaseback financing ($82 million) for 2015. Proceeds from the JV transactions are included in proceeds from sale-leaseback financing ($426

million) for 2015.

(2) Includes proceeds of $212 million received from ESL and its affiliates and $93 million received from Fairholme and its affiliates.

(3) Proceeds in 2014 include $400 million received from a secured short-term loan with JPP II, LLC and JPP, LLC, entities affiliated with ESL and

Fairholme, and $299 million and $179 million received from ESL and its affiliates and Fairholme and its affiliates, respectively, for the issuance of

Senior Unsecured Notes with warrants.

(4) Repayments in 2015 include $400 million of a secured short-term loan with JPP II, LLC and JPP, LLC, entities affiliated with ESL and Fairholme, and

$165 million, $110 million and $207 million of Senior Secured Notes to ESL, the Company's domestic pension plan and Fairholme and its affiliates,

respectively.

See accompanying Notes to Consolidated Financial Statements.

59