Sears 2015 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2015 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

estimates and assumptions used in estimating future cash flows and asset fair values, we may be exposed to

additional impairment charges in the future, which could be material to our results of operations.

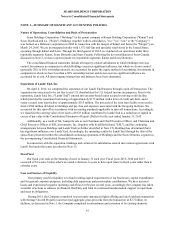

New Accounting Pronouncements

See Note 1 of Notes to Consolidated Financial Statements for information regarding new accounting

pronouncements.

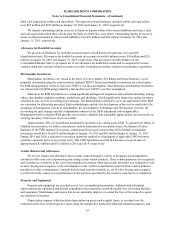

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Certain statements made in this Annual Report on Form€10-K and in other public announcements by us

contain forward-looking statements within the meaning of the Section 27A of the Securities Act of 1933, as

amended, Section 21E of the Securities Act of 1934, as amended, and the Private Securities Litigation Reform Act of

1995. Forward-looking statements include information concerning our future financial performance, business

strategy, plans, goals and objectives. Statements preceded or followed by, or that otherwise include, the words

"believes," "expects," "anticipates," "intends," "estimates," "plans," "forecast," "is likely to" and similar expressions

or future or conditional verbs such as "will," "may" and "could" are generally forward-looking in nature and not

historical facts. Such statements are based upon the current beliefs and expectations of the Company's management

and are subject to significant risks and uncertainties, many of which are beyond the Company's control, that may

cause our actual results, performance or achievements to be materially different from any future results, performance

or achievements expressed or implied by these forward-looking statements. Actual results may differ materially

from those set forth in the forward-looking statements.

The following factors, among others, could cause actual results to differ from those set forth in the forward-

looking statements: our ability to successfully implement our integrated retail strategy to transform our business; our

ability to successfully manage our inventory levels; initiatives to improve our liquidity through inventory

management and other actions; vendors’ lack of willingness to provide acceptable payment terms or otherwise

restricting financing to purchase inventory or services; possible limits on our access to our domestic credit facility,

which is subject to a borrowing base limitation and a springing fixed charge coverage ratio covenant, capital markets

and other financing sources, including additional second lien financings, with respect to which we do not have

commitments from lenders; our ability to successfully achieve our plans to generate liquidity through potential

transactions or otherwise; our ability to achieve cost savings initiatives; potential liabilities in connection with the

separation of Lands’ End and disposition of a portion of our ownership interest in Sears Canada; payment-related

risks that could increase our operating costs, expose us to fraud or theft, subject us to potential liability and

potentially disrupt our business operations; the impact of seasonal buying patterns, including seasonal fluctuations

due to weather conditions, which are difficult to forecast with certainty; fluctuations in our sales due to changes in

customers’ spending patterns and prevailing economic conditions; risks and uncertainties related to the Seritage

transaction and the amendment and extension of our credit facility, such as the impact of the evaluation of any such

transaction on our other businesses; our dependence on sources outside the United States for significant amounts of

our merchandise; our reliance on third parties to provide us with services in connection with the administration of

certain aspects of our business and the transfer of significant internal historical knowledge to such parties;

impairment charges for goodwill and intangible assets or fixed-asset impairment for long-lived assets; our ability to

attract, motivate and retain key executives and other associates; the substantial influence exerted over the Company

by affiliates of our Chairman and Chief Executive Officer, whose interests may diverge from other stockholders’

interests; our ability to protect or preserve the image of our brands; the outcome of pending and/or future legal

proceedings, including shareholder litigation, product liability, patent infringement and qui tam claims and

proceedings with respect to which the parties have reached a preliminary settlement; and the timing, amount and

other risks related to required pension plan funding.

Certain of these and other factors are discussed in more detail in Part I, Item 1A of this Annual Report on

Form 10-K. While we believe that our forecasts and assumptions are reasonable, we caution that actual results may

differ materially. We intend the forward-looking statements to speak only as of the time made and do not undertake

to update or revise them as more information becomes available, except as required by law.

53