Sears 2015 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2015 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

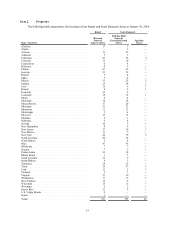

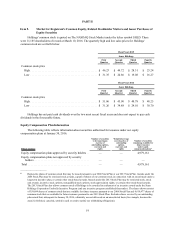

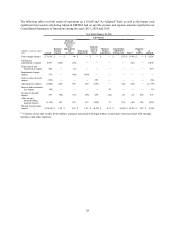

Purchase of Equity Securities

During the quarter ended January€30, 2016, we did not repurchase any shares of our common stock under our

common share repurchase program. At January€30, 2016, we had approximately $504 million of remaining

authorization under the program.

Total

Number of

Shares

Purchased(1)

Average

Price€Paid

per Share

Total€Number€of

Shares€Purchased

as€Part€of

Publicly

Announced

Program(2)

Average

Price€Paid

per€ Share

for

Publicly

Announced

Program

Approximate

Dollar Value of

Shares that May

Yet€Be€Purchased

Under

the€Program

November 1, 2015 to November 28,

2015 . . . . . . . . . . . . . . . . . . . . . . . . . . 1,048 $19.96 — $—

November 29, 2015 to January 2, 2016.— — — —

January 3, 2016 to January 30, 2016 . . . — — — —

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,048 $19.96 — $—$503,907,832

__________________

(1) Consists entirely of 1,048 shares acquired from associates to meet withholding tax requirements from the

vesting of restricted stock.

(2) Our common share repurchase program was initially announced on September€14, 2005 and has a total

authorization since inception of the program of $6.5 billion, including the authorizations to purchase up to an

additional $500 million of common stock on each of December€17, 2009 and May€2, 2011. The program has

no stated expiration date.

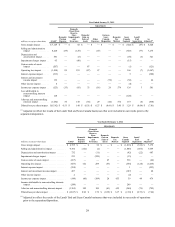

The Amended Domestic Credit Agreement (described in Management's Discussion and Analysis of Financial

Condition and Results of Operation - "Uses and Sources of Liquidity" section below) limits our ability to make

restricted payments, including dividends and share repurchases, subject to specified exceptions that are available if,

in each case, no event of default under the credit facility exists immediately before or after giving effect to the

restricted payment. These include exceptions that require that projected availability under the credit facility, as

defined, is at least 15%, exceptions that may be subject to certain maximum amounts and an exception that requires

that the restricted payment is funded from cash on hand and not from borrowings under the credit facility. Further,

the Amended Domestic Credit Agreement includes customary covenants that restrict our ability to make

dispositions, prepay debt, and make investments, subject, in each case, to various exceptions. The Amended

Domestic Credit Agreement also imposes various other requirements, which take effect if availability falls below

designated thresholds, including a cash dominion requirement and a requirement that the fixed charge ratio at the

last day of any quarter be not less than 1.0 to 1.0.

21