Sears 2015 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2015 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

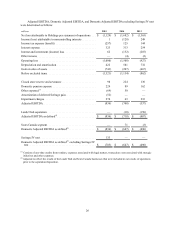

Adjusted EBITDA is computed as net loss attributable to Sears Holdings Corporation appearing on the

Statements of Operations excluding income (loss) attributable to noncontrolling interests, income tax (expense)

benefit, interest expense, interest and investment income (loss), other income, depreciation and amortization and

gain on sales of assets. In addition, it is adjusted to exclude certain significant items as set forth below. Our

management uses Adjusted EBITDA to evaluate the operating performance of our businesses, as well as executive

compensation metrics, for comparable periods. Adjusted EBITDA should not be used by investors or other third

parties as the sole basis for formulating investment decisions as it excludes a number of important cash and non-cash

recurring items.

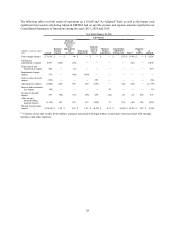

While Adjusted EBITDA, Domestic Adjusted EBITDA and Domestic Adjusted EBITDA excluding Seritage/

JV rent are non-GAAP measurements, management believes that they are important indicators of ongoing operating

performance, and useful to investors, because:

• EBITDA excludes the effects of financings and investing activities by eliminating the effects of interest and

depreciation costs;

• Management considers gains/(losses) on the sale of assets to result from investing decisions rather than

ongoing operations; and

• Other significant items, while periodically affecting our results, may vary significantly from period to

period and have a disproportionate effect in a given period, which affects comparability of results. We have

adjusted our results for these items to make our statements more comparable and therefore more useful to

investors as the items are not representative of our ongoing operations and reflect past investment

decisions.

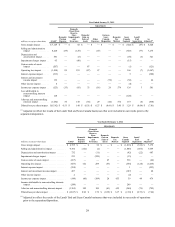

We also believe that our use of Adjusted EPS provides an appropriate measure for investors to use in assessing

our performance across periods, given that this measure provides an adjustment for certain significant items which

may vary significantly from period to period, improving the comparability of year-to-year results and is therefore

representative of our ongoing performance. Therefore, we have adjusted our results for significant items to make our

statements more useful and comparable. However, we do not, and do not recommend that you, solely use Adjusted

EPS to assess our financial and earnings performance. We also use, and recommend that you use, diluted earnings

per share in addition to Adjusted EPS in assessing our earnings performance.

These other significant items included in Adjusted EBITDA, Domestic Adjusted EBITDA, Domestic Adjusted

EBITDA excluding Seritage/JV rent and Adjusted EPS are further explained as follows:

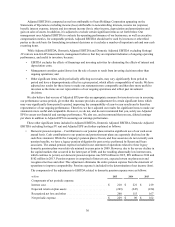

• Domestic pension expense – Contributions to our pension plans remain a significant use of our cash on an

annual basis. Cash contributions to our pension and postretirement plans are separately disclosed on the

cash flow statement. While the Company's pension plan is frozen, and thus associates do not currently earn

pension benefits, we have a legacy pension obligation for past service performed by Kmart and Sears

associates. The annual pension expense included in our statement of operations related to these legacy

domestic pension plans was relatively minimal in years prior to 2009. However, due to the severe decline in

the capital markets that occurred in the latter part of 2008, and the resulting abnormally low interest rates,

which continue to persist, our domestic pension expense was $229 million in 2015, $89 million in 2014 and

$162 million in 2013. Pension expense is comprised of interest cost, expected return on plan assets and

recognized net loss and other. This adjustment eliminates the entire pension expense from the statement of

operations to improve comparability. Pension expense is included in the determination of net income (loss).

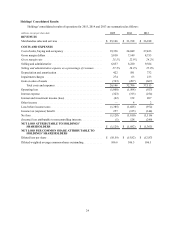

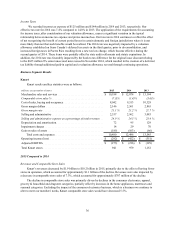

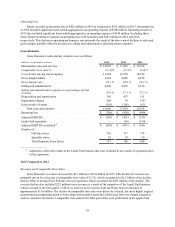

The components of the adjustments to EBITDA related to domestic pension expense were as follows:

millions 2015 2014 2013

Components of net periodic expense:

Interest cost. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $210 $221 $219

Expected return on plan assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . (249)(247)(224)

Recognized net loss and other . . . . . . . . . . . . . . . . . . . . . . . . . . . . 268 115 167

Net periodic expense. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $229 $89 $162

30