Sears 2015 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2015 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

softlines businesses, were negatively impacted by unseasonably warm weather and a highly promotional

environment.

Sears Domestic comparable store sales were also negatively impacted by consumer electronics. Excluding the

impact of consumer electronics, Sears Domestic comparable store sales would have decreased 9.5%, primarily

driven by decreases in apparel, home appliances, lawn & garden and Sears Auto Centers, which were partially offset

by an increase in the mattresses category.

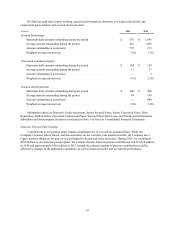

Gross Margin

Sears Domestic generated gross margin of $3.7 billion and $4.1 billion in 2015 and 2014, respectively, and

included significant items which aggregated to additional gross margin of $182 million and $73 million for 2015 and

2014, respectively. Excluding these items, gross margin decreased $531 million.

Sears Domestic's gross margin rate for the year improved 50 basis points to 24.5% in 2015 from 24.0% in

2014. Excluding the impact of significant items recorded in gross margin during the year, Sears Domestic's gross

margin rate declined 60 basis points, with the most notable decreases experienced in the apparel and home

appliances categories, primarily driven by increased promotional activities, particularly during the fourth quarter of

2015 as a result of the highly competitive promotional environment.

In addition, as a result of the Seritage and JV transactions, 2015 includes additional rent expense and assigned

sub-tenant rental income of approximately $108 million.

Selling and Administrative Expenses

Sears Domestic’s selling and administrative expenses decreased $335 million in 2015 as compared to 2014 and

included significant items which aggregated to $275 million and $211 million for 2015 and 2014, respectively.

Excluding these items, selling and administrative expenses decreased $399 million, primarily due to a decrease in

payroll expense.

Sears Domestic’s selling and administrative expense rate was 28.9% in 2015 and 27.3% in 2014 and increased

as the above noted expense reduction was more than offset by the decline in sales noted above.

Depreciation and Amortization

Depreciation and amortization expense decreased by $87 million during 2015 to $350 million, primarily due

to having fewer assets to depreciate.

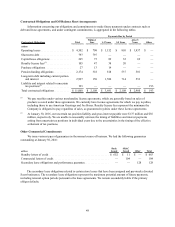

Impairment Charges

Sears Domestic recorded impairment charges of $260 million which consisted of impairment of $180 million

related to the Sears trade name, as well as $80 million related to the impairment of long-lived assets. We recorded

impairment charges of $19 million in 2014 related to the impairment of long-lived assets. Impairment charges

recorded in both years are described further in Notes 1 and 13 of Notes to Consolidated Financial Statements.

Gain on Sales of Assets

Sears Domestic recorded total gains on sales of assets of $558 million and $105 million in 2015 and 2014,

respectively. The gains recorded in 2015 included $371 million recognized in connection with the joint venture

transactions and the sale-leaseback transaction with Seritage. Gains on sales of assets recorded in both years are

described further in Note 11 of Notes to Consolidated Financial Statements.

Operating Loss

Sears Domestic reported an operating loss of $708 million in 2015 compared to $920 million in 2014. Sears

Domestic’s operating loss in 2015 included significant items which aggregated to operating income of $185 million,

while Sears Domestic's operating loss for 2014 included significant items which aggregated to operating expense of

$87 million. Excluding these items, we would have reported an operating loss of $893 million and $833 million for

40