Sears 2015 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2015 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

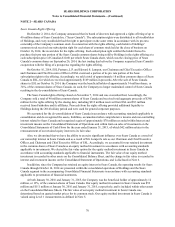

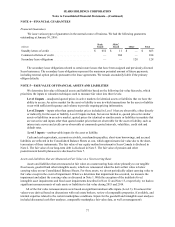

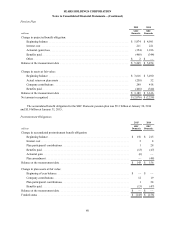

At January€30, 2016, long-term debt maturities for the next five years and thereafter were as follows:

millions

2016 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $71

2017 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 97

2018 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,290

2019 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 640

2020 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

Thereafter. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 327

Total maturities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,436

Unamortized debt discount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (245)

Unamortized debt issuance costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(12)

Long-term debt, net of discount & debt issuance costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $2,179

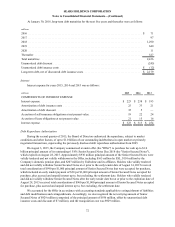

Interest

Interest expense for years 2015, 2014 and 2013 was as follows:

millions 2015 2014 2013

COMPONENTS OF INTEREST EXPENSE

Interest expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $223 $238 $193

Amortization of debt issuance costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25 33 21

Amortization of debt discount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35 5 —

Accretion of self-insurance obligations at net present value . . . . . . . . . . . . . . . . . . . . . . 19 22 24

Accretion of lease obligations at net present value . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21 15 16

Interest expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $323 $313 $254

Debt Repurchase Authorization

During the second quarter of 2015, the Board of Directors authorized the repurchase, subject to market

conditions and other factors, of up to $1.0 billion of our outstanding indebtedness in open market or privately

negotiated transactions, superseding the previously disclosed debt repurchase authorization from 2005.

On August 3, 2015, the Company commenced a tender offer (the "Offer") to purchase for cash up to $1.0

billion€principal amount of its outstanding 6 5/8% Senior Secured Notes Due 2018 (the "Senior Secured Notes"),

which expired on August 28, 2015. Approximately $936 million principal amount of the Senior Secured Notes were

validly tendered and not validly withdrawn in the Offer, including $165 million by ESL, $110 million by the

Company's domestic pension plan, and $207 million by Fairholme and its affiliates. Holders who validly tendered

and did not validly withdraw Senior Secured Notes at or prior to the early tender date of August 14, 2015 received

total consideration of $990 per $1,000 principal amount of Senior Secured Notes that were accepted for purchase,

which included an early tender payment of $30 per $1,000 principal amount of Senior Secured Notes accepted for

purchase, plus accrued and unpaid interest up to, but excluding, the settlement date. Holders who validly tendered

and did not validly withdraw Senior Secured Notes after the early tender date but at or prior to the expiration date of

August 28, 2015 received total consideration of $960 per $1,000 principal amount of Senior Secured Notes accepted

for purchase, plus accrued and unpaid interest up to, but excluding, the settlement date.

We accounted for the Offer in accordance with accounting standards applicable to extinguishment of liabilities

and debt modifications and extinguishments. Accordingly, we de-recognized the net carrying amount of Senior

Secured Notes of $929 million (comprised of the principal amount of $936 million, offset by unamortized debt

issuance costs and discount of $7 million), and the reacquisition cost was $929 million.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

72