Sears 2014 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2014 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

98

Level 2 as they are primarily valued by institutional bid evaluation, which determines the estimated price a dealer

would pay for a security and which is developed using proprietary models established by the pricing vendors for this

purpose.

Certain corporate and mortgage-backed and other asset-backed debt securities are assigned to Level 3 based

on the relatively low position in the preferred hierarchy of the pricing source. Valuation of the Plan's non-public

limited partnerships requires significant judgment by the general partners due to the absence of quoted market value,

inherent lack of liquidity, and the long-term nature of the assets, and may result in fair value measurements that are

not indicative of ultimate realizable value. Hedge funds consist of fund-of-funds investments and direct hedge funds

and are assigned to Level 3. The fund-of-funds investments are primarily valued using a market approach based on

the NAVs calculated by the fund and are not publicly available. Direct hedge funds are primarily valued by each

fund's third party administrator based on the valuation of the underlying type of security held and are not publicly

available. All hedge fund investments are in the process of being redeemed.

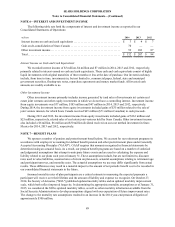

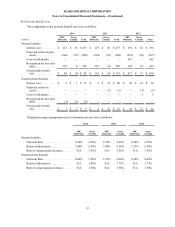

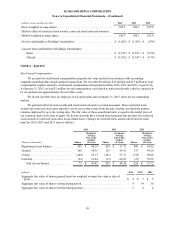

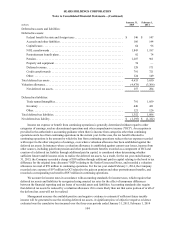

A rollforward of our Level 3 assets each year is as follows:

SHC Domestic

February 1,

2014

Balance

Net Realized and

Unrealized

Losses Purchases Sales and

Settlements

Net Transfers

Into/(Out of)

Level 3

January 31,

2015

Balance

millions

Fixed income securities:

Mortgage-backed and

asset-backed . . . . . . . . . $ — $ — $ 6 $ — $ — $ 6

Ventures and partnerships. . 6 — — (1) — 5

Total Level 3 investments. . $ 6 $ — $ 6 $ (1) $ — $ 11

SHC Domestic

February 2,

2013

Balance

Net Realized and

Unrealized

Gains/(Losses) Purchases Sales and

Settlements

Net Transfers

Into/(Out of)

Level 3

February 1,

2014

Balance

millions

Ventures and partnerships. . $ 12 $ (3) $ — $ (3) $ — $ 6

Total Level 3 investments. . $ 12 $ (3) $ — $ (3) $ — $ 6

Sears Canada

February 2,

2013

Balance

Net Realized and

Unrealized

Losses Purchases Sales and

Settlements

Net Transfers

Into/(Out of)

Level 3

February 1,

2014

Balance

millions

Fixed income securities:

Corporate bonds and

notes . . . . . . . . . . . . . . . $ 1 $ — $ 63 $ (1) $ — $ 63

Mortgage-backed and

asset-backed . . . . . . . . . 59 (2) — (9) — 48

Hedge and pooled equity

funds . . . . . . . . . . . . . . . . 3 — — (1) — 2

Total Level 3 investments. . $ 63 $ (2) $ 63 $ (11) $ — $ 113

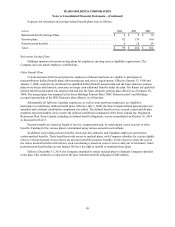

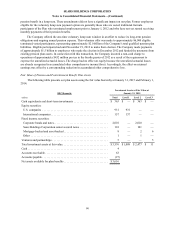

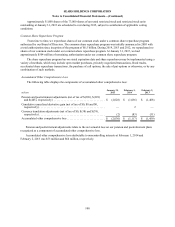

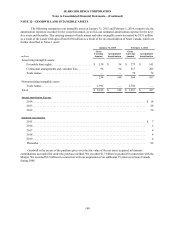

NOTE 8—EARNINGS PER SHARE

The following tables set forth the components used to calculate basic and diluted loss per share from

continuing operations attributable to Holdings' shareholders. Restricted stock awards for 2014, 2013 and 2012,

restricted stock units for 2014 and warrants issued in 2014, totaling 5 million shares, 0.2 million shares and 0.3

million shares in 2014, 2013 and 2012, respectively, were not included in the computation of diluted loss per share

attributable to Holdings' shareholders because the effect of their inclusion would have been antidilutive.