Sears 2014 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2014 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

105

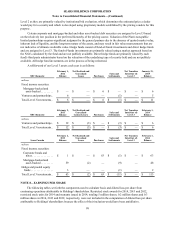

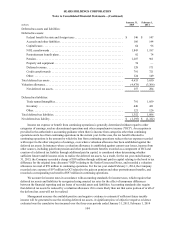

and February 2, 2013. Such objective evidence limits the ability to consider other subjective evidence such as our

projections for future income.

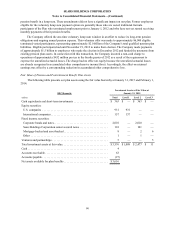

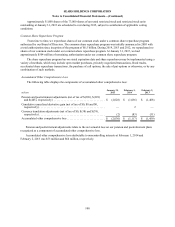

On the basis of this analysis and the significant negative objective evidence, for the year ended January 28,

2012, a valuation allowance of $2.1 billion was added to record only the portion of the deferred tax asset that more

likely than not will be realized. Of the total valuation allowance recorded, $317 million was recorded through other

comprehensive income. For the year ended February 2, 2013, $213 million of the valuation allowance increase was

recorded through other comprehensive income. For the year ended February 1, 2014, the valuation allowance

increased by $623 million, but none of the increase was recorded through other comprehensive income. Included in

the $623 million valuation allowance increase was $138 million for state separate entity deferred tax assets, as

Kmart Corporation incurred a three-year cumulative loss in 2013. For the year ended January 31, 2015, the valuation

allowance increased by $1.1 billion of which $454 million was recorded through other comprehensive income.

During the quarterly assessment of deferred tax assets for the year ended January 31, 2015, management

determined that it was no longer probable that sufficient future taxable income would be available to allow the

deferred tax assets of Sears Canada to be realized. A significant piece of negative evidence evaluated was the recent

and anticipated profitability were lower than previously projected. The Company also considered the impact on the

timing of the implementation of strategic initiatives at Sears Canada to improve profitability due to their recent

senior management changes and realization that certain strategies would not achieve previously expected targets. In

assessing the realizability of Sears Canada's deferred tax assets, management considered the four sources of taxable

income included in the accounting standards applicable for income taxes. Of these four sources of taxable income,

Sears Canada was only able to avail itself of future reversals of existing taxable differences and taxable income in

prior carryback years to realize a tax benefit of an existing deductible temporary difference. Therefore, a valuation

allowance of $152 million was added to record only the portion of the deferred tax asset that more likely than not

will be realized. We recognized the $152 million valuation allowance charge during the third quarter of 2014 in

continuing operations. This $152 million valuation allowance was de-recognized in the third quarter as part of the

Sears Canada de-consolidation.

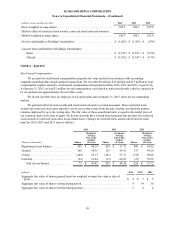

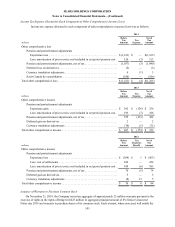

At January 31, 2015 and February 1, 2014, we had a valuation allowance of $4.5 billion and $3.4 billion,

respectively, to record only the portion of the deferred tax asset that more likely than not will be realized. The

amount of the deferred tax asset considered realizable, however, could be adjusted in the future if estimates of future

taxable income during the carryforward period are reduced or increased, or if the objective negative evidence in the

form of cumulative losses is no longer present and additional weight may be given to subjective evidence such as

our projections for growth. We will continue to evaluate our valuation allowance in future years for any change in

circumstances that causes a change in judgment about the realizability of the deferred tax asset.

At the end of 2014 and 2013, we had a federal and state net operating loss ("NOL") deferred tax asset of $1.8

billion and $1.2 billion, respectively, which will expire predominately between 2019 and 2035. We have credit

carryforwards of $791 million, which will expire between 2015 and 2035.

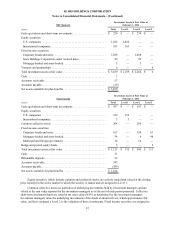

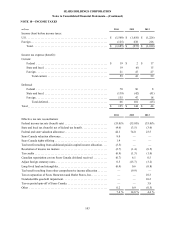

On April 4, 2014, Holdings and Lands' End entered into a tax sharing agreement in connection with the spin-

off. Pursuant to this agreement, Holdings is responsible for all pre-separation U.S. federal, state and local income

taxes attributable to the Lands’ End business, and Lands’ End is responsible for all other income taxes attributable to

its business, including all foreign taxes.

In connection with the Sears Canada Rights Offering in fiscal 2014, the Company incurred a taxable gain of

approximately $107 million on the subscription rights exercised and common shares sold during the fiscal year.

There was no income tax payable balance resulting from the taxable gain due to the utilization of NOL attributes of

approximately $38 million and a valuation allowance release of the same amount. In addition, a foreign tax credit

carryover of $15 million was generated and the valuation allowance increased by the same amount.

In connection with Sears Canada’s sale of real estate during 2013, Sears Canada declared an extraordinary

dividend of $5 Canadian per share on November 19, 2013. The Company received a taxable dividend of $260

million Canadian or $243 million resulting in a taxable income inclusion of $280 million, which includes a Section

78 Gross-up of $37 million. The amount of taxes otherwise payable resulting from the taxable dividend was reduced

by the utilization of $59 million of net deferred tax assets, primarily NOL carryforwards. As the Company had

previously recorded a valuation allowance against these NOL carryforwards, $59 million of the related valuation

allowance was released upon their utilization.