Sears 2014 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2014 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

92

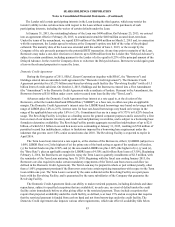

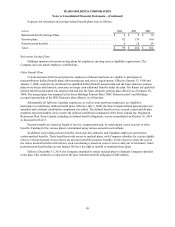

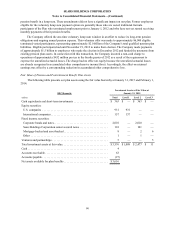

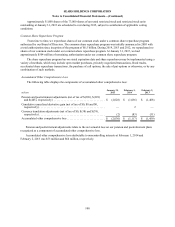

Postretirement Obligations

2014 2013

millions SHC

Domestic SHC

Domestic Sears

Canada Total

Change in accumulated postretirement benefit obligation:

Beginning balance. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 215 $ 247 $ 295 $ 542

Interest cost . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 8 12 20

Plan participants' contributions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28 31 — 31

Actuarial (gain) loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . —(15)(2)(17)

Benefits paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (47)(56)(15)(71)

Plan amendment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (48) — (46)(46)

Foreign currency exchange rate impact and other . . . . . . . . . . . . . . — — (28)(28)

Balance at the measurement date . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 156 $ 215 $ 216 $ 431

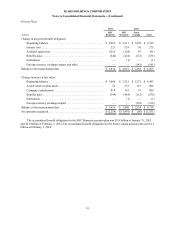

Change in plan assets at fair value:

Beginning of year balance. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ — $ — $ 45 $ 45

Actual return on plan assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — 1 1

Company contributions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19 25 1 26

Plan participants' contributions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28 31 — 31

Benefits paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (47)(56)(15)(71)

Foreign currency exchange rate impact and other . . . . . . . . . . . . . . — — (12)(12)

Balance at the measurement date . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ — $ — $ 20 $ 20

Funded status . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(156) $ (215) $ (196) $ (411)

The current portion of our liability for postretirement obligations is $15 million, which we expect to pay

during fiscal 2015.

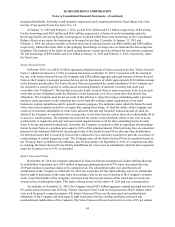

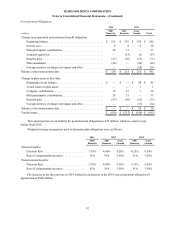

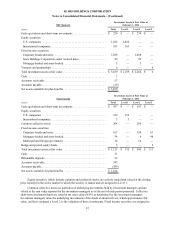

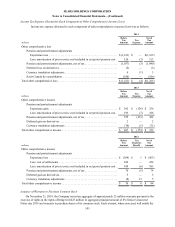

Weighted-average assumptions used to determine plan obligations were as follows:

2014 2013 2012

SHC

Domestic SHC

Domestic Sears

Canada SHC

Domestic Sears

Canada

Pension benefits:

Discount Rate. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.70% 4.60% 4.20% 4.25% 4.20%

Rate of compensation increases . . . . . . . . . . . . . . . N/A N/A 3.50% N/A 3.50%

Postretirement benefits:

Discount Rate. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.30% 4.00% 4.20% 3.55% 4.20%

Rate of compensation increases . . . . . . . . . . . . . . . N/A N/A 3.50% N/A 3.50%

The decrease in the discount rate in 2014 resulted in an increase in the 2014 year-end pension obligation of

approximately $500 million.