Sears 2014 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2014 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

21

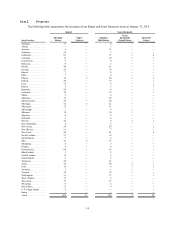

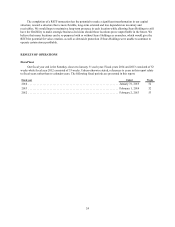

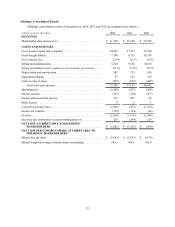

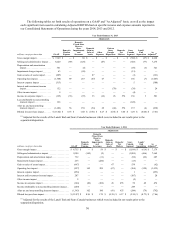

Item 6. Selected Financial Data

The table below summarizes our recent financial information. The data set forth below should be read in

conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations" in

Item 7 and our Consolidated Financial Statements and notes thereto in Item 8.

Fiscal

dollars in millions, except per share and store data 2014 2013 2012 2011 2010

Summary of Operations

Revenues (1) . . . . . . . . . . . . . . . . . . . . . . . . . . $ 31,198 $ 36,188 $ 39,854 $ 41,567 $ 42,664

Domestic comparable store sales % . . . . . . . (1.8)% (3.8)% (2.5)% (2.2)% (1.3)%

Net income (loss) from continuing

operations attributable to Holdings'

shareholders (2) . . . . . . . . . . . . . . . . . . . . . . (1,682) (1,365) (930) (3,113) 122

Per Common Share

Basic:

Net income (loss) from continuing

operations attributable to Holdings'

shareholders . . . . . . . . . . . . . . . . . . . . . . . $ (15.82) $ (12.87) $ (8.78) $ (29.15) $ 1.09

Diluted:

Net income (loss) from continuing

operations attributable to Holdings'

shareholders . . . . . . . . . . . . . . . . . . . . . . . $ (15.82) $ (12.87) $ (8.78) $ (29.15) $ 1.09

Holdings' book value per common share. . . . $ (8.93) $ 16.34 $ 25.89 $ 40.26 $ 78.19

Financial Data

Total assets. . . . . . . . . . . . . . . . . . . . . . . . . . . $ 13,209 $ 18,261 $ 19,340 $ 21,381 $ 24,360

Long-term debt . . . . . . . . . . . . . . . . . . . . . . . 2,900 2,559 1,579 1,693 1,872

Long-term capital lease obligations. . . . . . . . 210 275 364 395 472

Capital expenditures . . . . . . . . . . . . . . . . . . . 270 329 378 432 426

Adjusted EBITDA(3) . . . . . . . . . . . . . . . . . . . (718) (487) 428 51 1,085

Domestic Adjusted EBITDA(3) . . . . . . . . . . . (647) (490) 359 (50) 766

Number of stores . . . . . . . . . . . . . . . . . . . . . . 1,725 2,429 2,548 4,010 3,949

_________________

(1) We follow a retail-based financial reporting calendar. Accordingly, the fiscal year ended February 2, 2013 contained 53

weeks, while all other years presented contained 52 weeks.

(2) The periods presented were impacted by certain significant items, which affected the comparability of amounts reflected in

the above selected financial data. For 2014, 2013 and 2012, these significant items are discussed within Item 7,

"Management's Discussion and Analysis of Financial Condition and Results of Operations." 2011 results include the

impact of non-cash charges of $551 million related to the impairment of goodwill balances, a $1.8 billion non-cash charge

to establish a valuation allowance against our domestic deferred tax assets, domestic pension expense of $46 million, store

closings and severance of $225 million, mark-to-market losses of $3 million on Sears Canada hedge transactions, gain on

the sale of real estate of $20 million, and hurricane losses of $7 million. 2010 results include the impact of domestic

pension expense of $96 million, a $30 million charge related to store closings and severance, a gain on the sale of real

estate of $28 million, mark-to-market losses of $4 million on Sears Canada hedge transactions, a tax impact of $9 million

related to a dividend received from Sears Canada and a tax benefit of $13 million related to the resolution of certain

income tax matters.

(3) See "Management's Discussion and Analysis of Financial Condition and Results of Operations" in Item 7 for a

reconciliation of this measure to GAAP and a discussion of management’s reasoning for using such measure.