Sears 2014 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2014 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

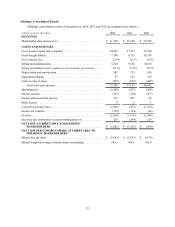

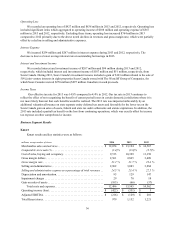

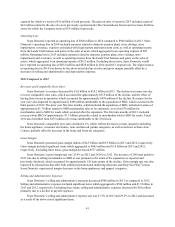

Year Ended February 2, 2013

Adjustments

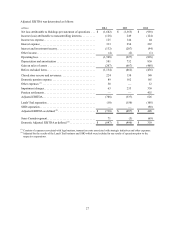

millions, except per share data GAAP

Domestic

Pension

Expense

Domestic

Closed Store

Reserve, Store

Impairments

and Severance

Domestic

Gain on

Sales of

Assets

Domestic

Transaction

Costs

Domestic

Pension

Settlements

Domestic

Tax

Matters

Sears

Canada

Segment Lands' End

Separation SHO

Separation As

Adjusted(2)

Gross margin impact . . . . . . . . . . . . . . . . . . . $10,514 $ — $ 35 $ — $ — $ — $ — $ (1,235) $ (606) $ (432) $ 8,276

Selling and administrative impact. . . . . . . . . 10,660 (165) (83) — (9) (452) — (1,192) (501) (343) 7,915

Depreciation and amortization impact . . . . . 830 — (22) — — — — (105) (23) (6) 674

Impairment charges impact . . . . . . . . . . . . . . 330 — (35) — — — — (295) — — —

Gain on sales of assets impact. . . . . . . . . . . . (468) — — 256 — — — 170 — — (42)

Operating loss impact . . . . . . . . . . . . . . . . . . (838) 165 175 (256) 9 452 — 187 (82) (83)(271)

Interest expense impact . . . . . . . . . . . . . . . . . (267) — — — — — — 9 — — (258)

Interest and investment income impact. . . . . 94 — — — — — — (51) — — 43

Other income impact . . . . . . . . . . . . . . . . . . . 1 — — — — — — (2) — — (1)

Income tax expense impact . . . . . . . . . . . . . . (44) (62) (66) 96 (3) — 164 32 32 33 182

Loss attributable to noncontrolling interests

impact . . . . . . . . . . . . . . . . . . . . . . . . . . . . 124 — — — — — — (124) — — —

After tax and noncontrolling interest impact.(930) 103 109 (160) 6 452 164 51 (50) (51)(306)

Diluted loss per share impact . . . . . . . . . . . . $ (8.78) $ 0.97 $ 1.03 $ (1.51) $ 0.06 $ 4.27 $ 1.55 $ 0.48 $ (0.47) $ (0.48) $ (2.88)

(2) Adjusted to reflect the results of the Lands' End, Sears Canada and Sears Hometown and Outlet businesses that were included

in our results of operations prior to the respective separations.

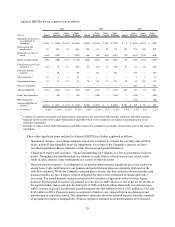

We also believe that our use of Adjusted EPS provides an appropriate measure for investors to use in assessing

our performance across periods, given that this measure provides an adjustment for certain significant items which

may vary significantly from period to period, improving the comparability of year-to-year results and is therefore

representative of our ongoing performance. Therefore, we have adjusted our results for them to make our statements

more useful and comparable. However, we do not, and do not recommend that you, solely use Adjusted EPS to

assess our financial and earnings performance. We also use, and recommend that you use, diluted earnings per share

in addition to Adjusted EPS in assessing our earnings performance.

In addition to the significant items included in the Adjusted EBITDA calculation, Adjusted EPS includes the

following other significant items which, while periodically affecting our results, may vary significantly from period

to period and have a disproportionate effect in a given period, and affects comparability of results.

• Domestic gains on sales of assets - We have recorded significant gains on sales of assets, as well as gains

on sales of joint venture interests, which were primarily attributable to several real estate transactions.

Management considers these gains on sale of assets to result from investing decisions rather than ongoing

operations.

• Domestic Tax Matters - In 2011, and again in 2013, we recorded a non-cash charge to establish a valuation

allowance against substantially all of our domestic deferred tax assets. Accounting rules generally require

that a valuation reserve be established when income has not been generated over a three-year cumulative

period to support the deferred tax asset. While an accounting loss was recorded, we believe no economic

loss has occurred as these net operating losses and tax benefits remain available to reduce future taxes as

income is generated in subsequent periods. As this valuation allowance has a significant impact on the

effective tax rate, we have adjusted our results to reflect a standard effective tax rate for the Company

beginning in fiscal 2011 when the valuation allowance was first established.

• Sears Canada Segment - The results of the Sears Canada business that were included in our results of

operations prior to the disposition. The adjustment also includes the valuation allowance that was recorded

in the third quarter of 2014 prior to the de-consolidation of Sears Canada.