Sears 2014 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2014 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

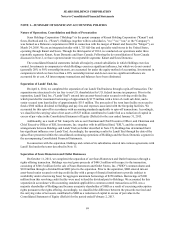

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

75

the amount of credit exposure in any one financial instrument. We use high credit quality counterparties to transact

our derivative transactions.

Cash and cash equivalents, accounts receivable, merchandise payables, credit facility borrowings and accrued

liabilities are reflected in the Consolidated Balance Sheet at cost, which approximates fair value due to the short-

term nature of these instruments. The fair value of our debt is disclosed in Note 3.

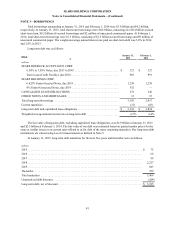

Self-insurance Reserves

We are self-insured for certain costs related to workers' compensation, asbestos, environmental, automobile,

warranty, product and general liability claims. We obtain third-party insurance coverage to limit our exposure to

certain of these self-insured risks. A portion of these self-insured risks is managed through a wholly-owned

insurance subsidiary. Our liability reflected on the Consolidated Balance Sheet, classified within other liabilities

(current and long-term), represents an estimate of the ultimate cost of claims incurred at the balance sheet date. In

estimating this liability, we utilize loss development factors based on Company-specific data to project the future

development of incurred losses. Loss estimates are adjusted based upon actual claims settlements and reported

claims. The liabilities for self-insured risks are discounted to their net present values using an interest rate which is

based upon the expected duration of the liabilities. Expected payments as of January 31, 2015 were as follows:

millions

2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 211

2016 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 138

2017 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 102

2018 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 76

2019 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 55

Later years . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 333

Total undiscounted obligation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 915

Less—discount. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (88)

Net obligation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 827

Loss Contingencies

We account for contingent losses in accordance with accounting standards pertaining to loss contingencies.

Under accounting standards, loss contingency provisions are recorded for probable losses at management's best

estimate of a loss, or when a best estimate cannot be made, the minimum amount in the estimated range is recorded.

These estimates are often initially developed substantially earlier than the ultimate loss is known, and the estimates

are refined each accounting period, as additional information is known.

Revenue Recognition

Revenues include sales of merchandise, services and extended service contracts, net commissions earned from

leased departments in retail stores, delivery and handling revenues related to merchandise sold, and fees earned from

co-branded credit card programs. We recognize revenues from retail operations at the later of the point of sale or the

delivery of goods to the customer. Direct to customer revenues are recognized when the merchandise is delivered to

the customer. Revenues from product installation and repair services are recognized at the time the services are

provided. Revenues from the sale of service contracts and the related direct acquisition costs are deferred and

amortized over the lives of the associated contracts, while the associated service costs are expensed as incurred.

We earn revenues through arrangements with third-party financial institutions that manage and directly extend

credit relative to our co-branded credit card programs. The third-party financial institutions pay us for generating

new accounts and sales activity on co-branded cards, as well as for selling other financial products to cardholders.

We recognize these revenues in the period earned, which is when our related performance obligations have been

met. We sell gift cards to customers at our retail stores and through our direct to customer operations. The gift cards