Sears 2014 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2014 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

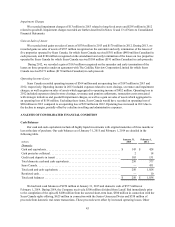

Operating Loss

We recorded an operating loss of $927 million and $838 million in 2013 and 2012, respectively. Operating loss

included significant items which aggregated to operating income of $108 million and operating expense of $567

million in 2013 and 2012, respectively. Excluding these items, operating loss increased $764 million in 2013

compared to 2012 primarily due to the above noted declines in revenues and gross margin rate, which were partially

offset by a decline in selling and administrative expenses.

Interest Expense

We incurred $254 million and $267 million in interest expense during 2013 and 2012, respectively. The

decrease is due to a lower average interest rate on outstanding borrowings in 2013.

Interest and Investment Income

We recorded interest and investment income of $207 million and $94 million during 2013 and 2012,

respectively, which included interest and investment income of $187 million and $51 million, respectively, from

Sears Canada. During 2013, Sears Canada's investment income included a gain of $163 million related to the sale of

50% joint venture interests in eight properties Sears Canada owned with The Westcliff Group of Companies, for

which Sears Canada received $270 million ($297 million Canadian) in cash proceeds.

Income Taxes

Our effective tax rate for 2013 was 14.8% compared to 4.4% in 2012. Our tax rate in 2013 continues to

reflect the effect of not recognizing the benefit of current period losses in certain domestic jurisdictions where it is

not more likely than not that such benefits would be realized. The 2013 rate was impacted unfavorably by an

additional valuation allowance on state separate entity deferred tax assets and favorably for the lower tax on the

Sears Canada gain on sales of assets, federal and state tax audit settlements and statute expirations. In addition, the

2013 rate included a partial tax benefit on the loss from continuing operations, which was exactly offset by income

tax expense on other comprehensive income.

Business Segment Results

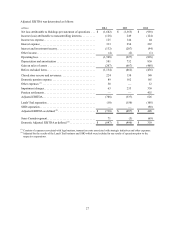

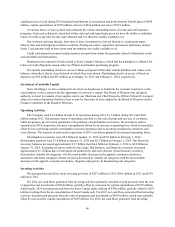

Kmart

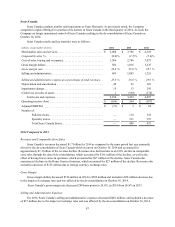

Kmart results and key statistics were as follows:

millions, except number of stores 2014 2013 2012

Merchandise sales and services . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 12,074 $ 13,194 $ 14,567

Comparable store sales % . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1.4)% (3.6)% (3.7)%

Cost of sales, buying and occupancy. . . . . . . . . . . . . . . . . . . . . . . . . . . . 9,513 10,329 11,158

Gross margin dollars . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,561 2,865 3,409

Gross margin rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21.2 % 21.7 % 23.4 %

Selling and administrative . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,962 3,083 3,284

Selling and administrative expense as a percentage of total revenues . . 24.5 % 23.4 % 22.5 %

Depreciation and amortization. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 95 129 147

Impairment charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29 70 10

Gain on sales of assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (103) (66) (37)

Total costs and expenses. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12,496 13,545 14,562

Operating income (loss). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (422) $ (351) $ 5

Adjusted EBITDA . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (216) $ (129) $ 201

Total Kmart stores . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 979 1,152 1,221