Sears 2014 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2014 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

94

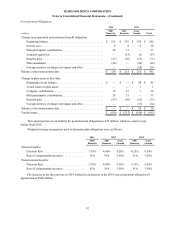

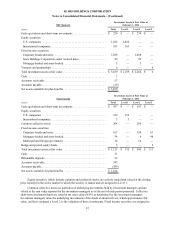

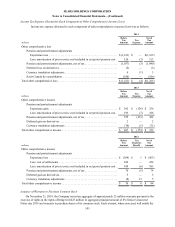

For purposes of determining the periodic expense of our defined benefit plans, we use the fair value of plan

assets as the market related value. A one-percentage-point change in the assumed discount rate would have the

following effects on the pension liability:

millions 1 percentage-point

Increase 1 percentage-point

Decrease

Effect on interest cost component . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 29 $ (37)

Effect on pension benefit obligation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(602) $ 728

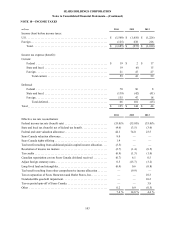

For 2015 and beyond, the domestic weighted-average health care cost trend rates used in measuring the

postretirement benefit expense are a 7.5% trend rate in 2015 to an ultimate trend rate of 5.5% in 2019. A one-

percentage-point increase or decrease in the assumed health care cost trend rate would have had essentially no

impact on the postretirement liability.

Approximately $262 million of the unrecognized net losses in accumulated other comprehensive income are

expected to be amortized as a component of net periodic benefit cost during 2015.

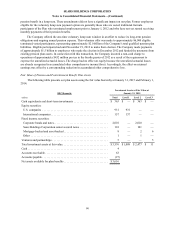

Investment Strategy

The Investment Committee, made up of select members of senior management, has appointed a non-affiliated

third party professional to advise the Committee with respect to the SHC domestic pension plan assets. The plan's

overall investment objective is to provide a long-term return that, along with Company contributions, is expected to

meet future benefit payment requirements. A long-term horizon has been adopted in establishing investment policy

such that the likelihood and duration of investment losses are carefully weighed against the long-term potential for

appreciation of assets. The plan's investment policy requires investments to be diversified across individual

securities, industries, market capitalization and valuation characteristics. In addition, various techniques are utilized

to monitor, measure and manage risk.

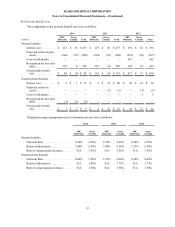

Domestic plan assets were invested in the following classes of securities:

Plan Assets at

January 31,

2015 February 1,

2014

Equity securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33% 36%

Fixed income and other debt securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 63 59

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 5

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 100% 100%

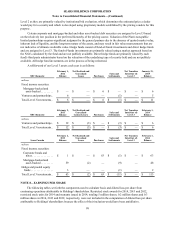

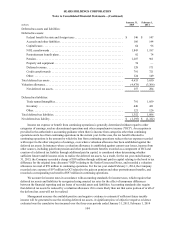

The domestic plan's target allocation is determined by taking into consideration the amounts and timing of

projected liabilities, our funding policies and expected returns on various asset classes. At January 31, 2015, the

plan's target asset allocation was 35% equity and 65% fixed income. To develop the expected long-term rate of

return on assets assumption, we considered the historical returns and the future expectations for returns for each

asset class, as well as the target asset allocation of the pension portfolio.

Sears Canada plan assets were invested in the following classes of securities (none of which were securities of

the Company):

Plan Assets at

February 1,

2014

Equity securities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26%

Fixed income and other debt securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 74

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 100%