Sears 2014 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2014 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

for the senior unsecured notes with warrants and $358 million in additional proceeds from domestic real estate

transactions.

These actions taken in 2014, demonstrate the Company's financial flexibility and provides us with the means to

fund our transformation and meet our obligations. As we leverage Shop Your Way® and Integrated Retail, we will

continue to right-size, redeploy and highlight the value of our assets, including our substantial real estate portfolio,

in our transition from an asset intensive, historically "store-only" based retailer to a more asset light, integrated

membership-focused company. We continue to take action to evolve and transition our capital structure toward a

structure that is more flexible, long-term oriented and less dependent on inventory and receivables. We have proven

that Holdings is an asset-rich enterprise with multiple levers to generate continued financial flexibility, while

creating shareholder value.

We are continuing our efforts to develop Holdings as a membership company, without the significant asset

intensity of its traditional retail business. To this end, we announced in November 2014 that we have been exploring

the formation of a Real Estate Investment Trust ("REIT") to purchase some of our properties and to manage them

like a pure real estate company. While we can offer no assurances that such a transaction will be consummated, we

have made progress and are proceeding towards its formation and separation, which is projected to occur in May or

June of this year. We are currently targeting between 200 and 300 Sears and Kmart stores to be sold to the REIT

with expected proceeds to Holdings in excess of $2.0 billion. The REIT itself would be funded by equity and debt

with the equity raised through a rights offering. The subscription rights would be distributed pro rata to all

stockholders of record of the Company, and every stockholder would have the right to participate, except that

holders of the Company's restricted stock that is unvested as of the record date would be expected to receive cash

awards in lieu of subscription rights.

We cannot predict the outcome of the actions to generate liquidity to fund the transformation discussed above,

or whether such actions would generate the expected liquidity to fund the transformation as currently planned. If we

continue to experience operating losses, and we are not able to generate enough funds from the above actions (or

some combination of other actions), the availability under our domestic credit facility might be fully utilized and we

would need to secure additional sources of funds. Moreover, if the borrowing base (as calculated pursuant to the

indenture) falls below the principal amount of the notes plus the principal amount of any other indebtedness for

borrowed money that is secured by liens on the collateral for the notes on the last day of any two consecutive

quarters, it could trigger an obligation to repurchase notes in an amount equal to such deficiency.

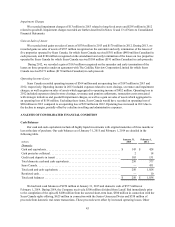

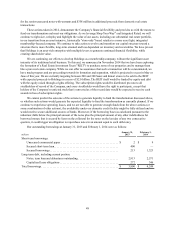

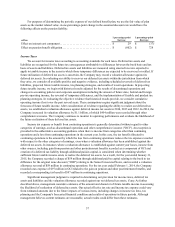

Our outstanding borrowings at January 31, 2015 and February 1, 2014 were as follows:

millions January 31,

2015 February 1,

2014

Short-term borrowings:

Unsecured commercial paper . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2 $ 9

Secured short-term loan. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 400 —

Secured borrowings. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 213 1,323

Long-term debt, including current portion:

Notes, term loan and debentures outstanding . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,913 2,571

Capitalized lease obligations. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 272 346

Total borrowings. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3,800 $ 4,249