Sears 2014 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2014 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.5

Separation of Sears Hometown and Outlet Businesses

On October 11, 2012, we completed the separation of our Sears Hometown and Outlet businesses through a

rights offering transaction. Holdings received gross proceeds of $446.5 million with respect to the transaction,

consisting of $346.5 million for the sale of Sears Hometown and Outlet Stores, Inc. ("SHO") common shares and

$100 million through a dividend from SHO prior to the separation. Prior to the separation, SHO entered into an

asset-based senior secured revolving credit facility with a group of financial institutions to provide (subject to

availability under a borrowing base) for aggregate maximum borrowings of $250 million. Borrowings of $100

million from this revolving credit facility were used to fund the dividend paid to Holdings. We accounted for this

separation in accordance with accounting standards applicable to common control transactions as ESL was a

majority shareholder of Holdings and became a majority shareholder of SHO as a result of exercising subscription

rights pursuant to the rights offering. Accordingly, we classified the difference between the proceeds received and

the carrying value of net assets contributed to SHO as a reduction of capital in excess of par value in the

Consolidated Statement of Equity for the period ended February 2, 2013.

In connection with the separation, Holdings and certain of its subsidiaries entered into various agreements with

SHO under the terms described in Note 15. Because of the various agreements with SHO, the Company has

determined that it has significant continuing cash flows with SHO. Accordingly, the operating results for SHO

through the date of the separation are presented within the consolidated continuing operations of Holdings and the

Sears Domestic segment in the accompanying Consolidated Financial Statements. See Note 15 of Notes to

Consolidated Financial Statements for further information related to the agreements with SHO.

Partial Spin-Off of Interest in Sears Canada

On November 13, 2012, we completed a partial spin-off (the "spin-off") of our interest in Sears Canada. Prior

to the spin-off, Holdings beneficially owned approximately 96% of the issued and outstanding common shares of

Sears Canada. In connection with the spin-off, we distributed approximately 45 million common shares of Sears

Canada held by Holdings on a pro rata basis to holders of Holdings' common stock. Following the spin-off,

Holdings was the beneficial holder of approximately 51% of the issued and outstanding common shares of Sears

Canada, and as such, Holdings maintained control of Sears Canada and, prior to de-consolidation in October 2014,

continued to consolidate the results of Sears Canada. We accounted for the spin-off as an equity transaction in

accordance with accounting standards applicable to noncontrolling interests. Accordingly, we reclassified a portion

of our ownership interest in Sears Canada and accumulated other comprehensive loss to noncontrolling interest in

the Consolidated Statement of Equity at February 2, 2013.

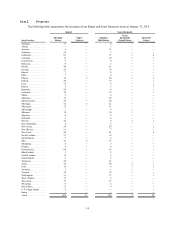

Real Estate Transactions

In the normal course of business, we consider opportunities to purchase leased operating properties, as well as

offers to sell owned, or assign leased, operating and non-operating properties. These transactions may, individually

or in the aggregate, result in material proceeds or outlays of cash. In addition, we review leases that will expire in

the short term in order to determine the appropriate action to take with respect to them.

Further information concerning our real estate transactions is contained in Note 11 of Notes to Consolidated

Financial Statements.

Trademarks and Trade Names

The KMART® and SEARS® trade names, service marks and trademarks, used by us both in the United States

and internationally, are material to our retail and other related businesses.

We sell proprietary branded merchandise under a number of brand names that are important to our operations.

Our KENMORE®, CRAFTSMAN® and DIEHARD® brands are among the most recognized proprietary brands in

retailing. These marks are the subject of numerous United States and foreign trademark registrations. Other well

recognized Company trademarks and service marks include CANYON RIVER BLUES®, COVINGTON®, SHOP

YOUR WAY®, SMART SENSE®, STRUCTURE®, THOM MCAN® and TOUGHSKINS®, which also are registered

or are the subject of pending registration applications in the United States. Generally, our rights in our trade names

and marks continue so long as we use them.