Sears 2014 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2014 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SEARS HOLDINGS CORPORATION

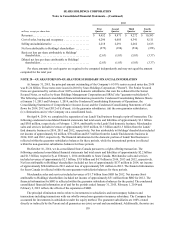

Notes to Consolidated Financial Statements—(Continued)

113

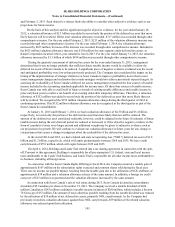

of the pledged collateral. The maturity date of the Loan was extended until the earlier of June 1, 2015, or the receipt

by the Company of the sale proceeds pursuant to the potential REIT transaction. At any time prior to maturity of the

Loan, Borrowers may make a one-time election to re-borrow up to $200 million from the Lender (the "Delayed

Advance"), subject to certain conditions, including payment to the Lender of a fee equal to 0.25% of the principal

amount of the Delayed Advance. In the event the Company elects to re-borrow the Delayed Advance, Borrowers

would again grant a lien on the released properties to secure the Loan. See Note 3 for additional information

regarding the Loan.

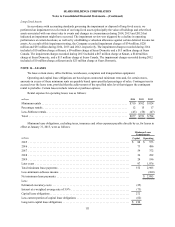

Senior Secured Notes and Subsidiary Notes

At January 31, 2015 and February 1, 2014, Mr. Lampert and ESL held an aggregate of $205 million and $95

million, respectively, of principal amount of the Company's 6 5/8% Senior Secured Notes due 2018. At both

January 31, 2015 and February 1, 2014, Mr. Lampert and ESL held an aggregate of $3 million of principal amount

of unsecured notes issued by SRAC (the "Subsidiary Notes").

Senior Unsecured Notes and Warrants

At January 31, 2015, Mr. Lampert and ESL held an aggregate of $299 million of principal amount of the

Company's Senior Unsecured Notes, and 10,530,633 warrants to purchase shares of Holdings common stock.

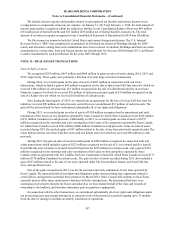

Trade Receivable Put Agreements

On January 26, 2012, ESL entered into an agreement with a financial institution to acquire from the financial

institution an undivided participating interest in a certain percentage of its rights and obligations under trade

receivable put agreements that were entered into with certain vendors of the Company. These agreements generally

provide that, in the event of a bankruptcy filing by the Company, the financial institution will purchase such

vendors’ accounts receivable arising from the sale of goods or services to the Company. ESL may from time to time

choose to purchase an 80% undivided participating interest in the rights and obligations primarily arising under

future trade receivable put agreements that the financial institution enters into with our vendors during the term of its

agreement. The Company is not a party to any of these agreements. At January 31, 2015, ESL held no participating

interest. At February 1, 2014, ESL held a participating interest totaling $80 million in the financial institution’s

agreements relating to the Company.

Sears Canada

ESL owns approximately 50% of the outstanding common shares of Sears Canada (based on publicly available

information as of November 13, 2014).

Lands' End

ESL owns approximately 49% of the outstanding common stock of Lands' End (based on publicly available

information as of April 4, 2014). Holdings and certain of its subsidiaries entered into a transition services agreement

in connection with the spin-off pursuant to which Lands' End and Holdings will provide to each other, on an interim,

transitional basis, various services, which may include, but are not limited to, tax services, logistics services,

auditing and compliance services, inventory management services, information technology services and continued

participation in certain contracts shared with Holdings and its subsidiaries, as well as agreements related to Lands'

End Shops at Sears and participation in the Shop Your Way® program.

Amounts due to or from Lands’ End are non-interest bearing, and generally settled on a net basis. Holdings

invoices Lands' End on at least a monthly basis. At January 31, 2015, Holdings reported a net amount receivable

from Lands' End of $5 million in the Accounts receivable line of the Consolidated Balance Sheet. Amounts related

to revenue from retail services and rent for Lands' End Shops at Sears, participation in the Shop Your Way® program

and corporate shared services were $63 million during 2014. The amounts Lands' End earned related to call center

services and commissions were $9 million during 2014.