Sears 2014 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2014 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

131

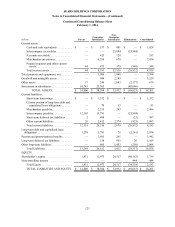

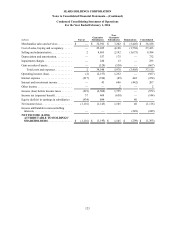

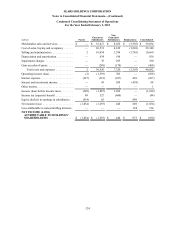

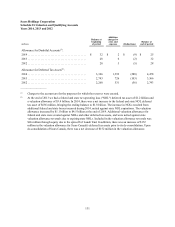

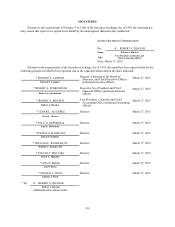

Sears Holdings Corporation

Schedule II-Valuation and Qualifying Accounts

Years 2014, 2013 and 2012

millions

Balance at

beginning

of period

Additions

charged to

costs and

expenses (Deductions) Balance at

end of period

Allowance for Doubtful Accounts(1):

2014 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 32 $ 2 $ (9) $ 25

2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28 6 (2) 32

2012 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28 5 (5) 28

Allowance for Deferred Tax Assets(2):

2014 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,366 1,392 (280) 4,478

2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,743 726 (103) 3,366

2012 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,268 531 (56) 2,743

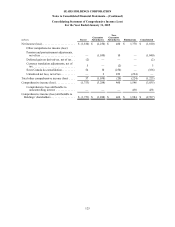

__________________

(1) Charges to the account are for the purposes for which the reserves were created.

(2) At the end of 2013 we had a federal and state net operating loss ("NOL") deferred tax asset of $1.2 billion and

a valuation allowance of $3.4 billion. In 2014, there was a net increase to the federal and state NOL deferred

tax asset of $656 million, bringing the ending balance to $1.8 billion. The increase in NOLs resulted from

additional federal and state losses incurred during 2014, netted against state NOL expirations. The valuation

allowance increased by $1.1 billion to $4.5 billion at the end of 2014. Additional valuation allowances for

federal and state were created against NOLs and other deferred tax assets, and were netted against state

valuation allowance reversals due to expiring state NOLs. Included in the valuation allowance reversals was

$26 million through equity due to the spin-off of Lands' End. In addition, there was an increase of $152

million in the valuation allowance for Sears Canada's deferred tax assets prior to its de-consolidation. Upon

de-consolidation of Sears Canada, there was a net decrease of $152 million in the valuation allowance.