Sears 2014 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2014 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.59

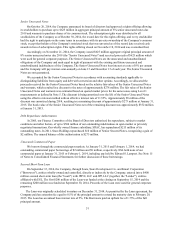

goodwill recorded at this reporting unit was impaired and recorded charges of $295 million in 2012. We did not

record any goodwill impairment charges in 2014 or 2013.

The use of different assumptions, estimates or judgments in either step of the goodwill impairment testing

process, such as the estimated future cash flows of the reporting unit, the discount rate used to discount such cash

flows, or the estimated fair value of the reporting unit's tangible and intangible assets and liabilities, could

significantly increase or decrease the estimated fair value of the reporting unit or its net assets, and therefore, impact

the related impairment charge. At the 2014 annual impairment test date, the conclusion that no indication of

goodwill impairment existed for the reporting unit would not have changed had the test been conducted assuming:

(1) a 100 basis point increase in the discount rate used to discount the aggregate estimated cash flows of the

reporting unit to its net present value in determining their estimated fair values and/or (2) a 100 basis point decrease

in the estimated sales growth rate and/or terminal period growth rate.

Based on our sensitivity analysis, we do not believe that the remaining recorded goodwill balance is at risk of

impairment at the reporting unit at the end of the year because the fair value is in excess of the carrying value and

not at risk of failing step one. However, goodwill impairment charges may be recognized in future periods in the

reporting unit to the extent changes in factors or circumstances occur, including deterioration in the macroeconomic

environment, retail industry or in the equity markets, which includes the market value of our common shares,

deterioration in our performance or our future projections, or changes in our plans for the reporting unit.

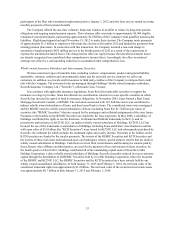

Intangible Asset Impairment Assessments

We review indefinite-lived intangible assets, primarily trade names, for impairment by comparing the carrying

amount of each asset to the sum of discounted cash flows expected to be generated by the asset. We consider the

income approach when testing intangible assets with indefinite lives for impairment on an annual basis. We

determined that the income approach, specifically the Relief from Royalty Method, was most appropriate for

analyzing our indefinite-lived assets. This method is based on the assumption that, in lieu of ownership, a firm

would be willing to pay a royalty in order to exploit the related benefits of this asset class. The Relief from Royalty

Method involves two steps: (1) estimation of reasonable royalty rates for the assets and (2) the application of these

royalty rates to a net sales stream and discounting the resulting cash flows to determine a value. We multiplied the

selected royalty rate by the forecasted net sales stream to calculate the cost savings (relief from royalty payment)

associated with the assets. The cash flows are then discounted to present value by the selected discount rate and

compared to the carrying value of the assets. We did not record any intangible asset impairment charges in 2014,

2013 or 2012.

The use of different assumptions, estimates or judgments in our intangible asset impairment testing process,

such as the estimated future cash flows of assets and the discount rate used to discount such cash flows, could

significantly increase or decrease the estimated fair value of an asset, and therefore, impact the related impairment

charge. At the 2014 annual impairment test date, the above-noted conclusion that no indication of intangible asset

impairment existed at the test date would have changed had the test been conducted assuming: (1) a 100 basis point

increase in the discount rate used to discount the aggregate estimated cash flows of our assets to their net present

value in determining their estimated fair values (without any change in the aggregate estimated cash flows of our

intangibles), (2) a 100 basis point decrease in the terminal period growth rate without a change in the discount rate

of each intangible, or (3) a 10 basis point decrease in the royalty rate applied to the forecasted net sales stream of our

assets and would have resulted in a potential impairment of approximately $72 million under any of those scenarios.

Based on our analysis, we do not believe that the indefinite-lived intangible balance is impaired at the end of

the year because the fair values are in excess of the carrying values. However, indefinite-lived intangible impairment

charges may be recognized in future periods to the extent changes in factors or circumstances occur, including

deterioration in the macroeconomic environment, retail industry, deterioration in our performance or our future

projections, or changes in our plans for one or more indefinite-lived intangible asset. We will continue to monitor for

such changes in facts or circumstances, which may be indicators of potential impairment triggers, and may result in

an impairment charge in a future period.