Sears 2014 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2014 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.40

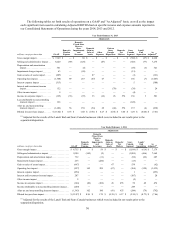

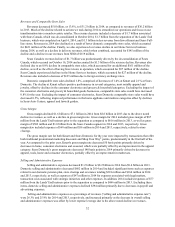

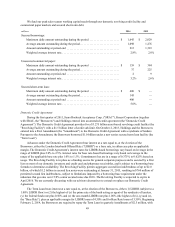

2014 Compared to 2013

Revenues and Comparable Store Sales

Sears Domestic's revenues decreased by $2.2 billion to $17.0 billion in 2014. The decline in revenue was

driven by the separation of the Lands' End business, which was completed on April 4, 2014, and accounted for $1.3

billion of the decline, as well as the effect of having fewer Full-line stores in operation in 2014, which accounted for

$311 million of the decline. Sears Domestic also experienced a revenue decline in its Home Services business in

2014 of $139 million, as well as a decline in revenues from SHO of $119 million. Revenues were also impacted by a

decrease in comparable store sales of 2.1%, which accounted for $251 million of the decline.

Excluding the impact of consumer electronics, Sears Domestic comparable store sales would have decreased

0.5%, reflecting improved performance in the home appliance and mattress categories offset by declines in Sears

Auto Centers, apparel and lawn & garden.

Gross Margin

Sears Domestic generated gross margin of $4.1 billion and $4.9 billion in 2014 and 2013, respectively. Gross

margin for 2014 and 2013 included charges related to store closures of $14 million and $11 million, respectively, as

well as gross margin of $87 million and $616 million from the Lands' End business in 2014 and 2013, respectively.

Excluding these items, gross margin decreased $256 million.

Sears Domestic’s gross margin rate was 24.0% in 2014 and 25.4% in 2013 and was impacted by transactions

that offer both traditional promotional marketing discounts and Shop Your Way® points, predominantly in the first

half of the year. The decrease in gross margin rate of 140 basis points in 2014 was primarily driven by decreases in

apparel, tools, home and consumer electronics, partially offset by an improvement in mattresses.

Selling and Administrative Expenses

Sears Domestic’s selling and administrative expenses decreased $561 million in 2014 as compared to 2013.

Selling and administrative expenses were impacted by expenses related to domestic pension plans, store closings

and severance of $130 million and $120 million in 2014 and 2013, respectively. Selling and administrative expenses

also included expenses of $77 million and $466 million related to the Lands' End business in 2014 and 2013,

respectively, while 2014 also included $4 million of expenses related to legal matters and transactions costs

associated with strategic initiatives. Excluding these items, selling and administrative expenses decreased by $186

million primarily due to declines in payroll and advertising expenses.

Sears Domestic’s selling and administrative expense rate was 27.3% in 2014 and 27.2% in 2013 and increased

slightly as the above noted expense reduction was more than offset by the decline in sales noted above.

Depreciation and Amortization

Depreciation and amortization expense decreased $74 million in 2014 to $437 million and included charges of

$4 million and $2 million in 2014 and 2013, respectively, taken in connection with store closings. The decrease is

primarily attributable to having fewer assets available for depreciation.

Impairment Charges

Sears Domestic recorded impairment charges of $19 million and $150 million in 2014 and 2013, respectively,

related to the impairment of long-lived assets. Impairment charges recorded in both years are described further in

Note 13 of Notes to Consolidated Financial Statements.

Gain on Sales of Assets

Sears Domestic recorded total gains on sales of assets of $105 million in 2014 and $63 million in 2013, which

were primarily attributable to several significant real estate transactions. The gain on the sales of assets in 2014

included a gain of $64 million recognized on the sale of three Sears Full-line stores for which we received $106

million of cash proceeds and $13 million recognized on the sale of a distribution facility in our Sears Domestic