Sears 2014 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2014 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

101

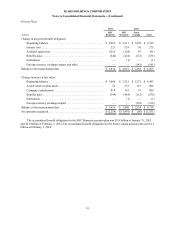

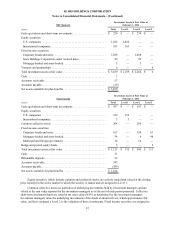

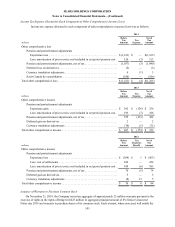

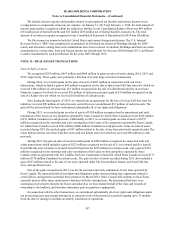

Income Tax Expense Allocated to Each Component of Other Comprehensive Income (Loss)

Income tax expense allocated to each component of other comprehensive income (loss) was as follows:

2014

millions

Before

Tax

Amount Tax

Expense

Net of

Tax

Amount

Other comprehensive loss

Pension and postretirement adjustments

Experience loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(1,163) $ — $(1,163)

Less: amortization of prior service cost included in net period pension cost .126 (3) 123

Pension and postretirement adjustments, net of tax . . . . . . . . . . . . . . . . . . . . . . . (1,037)(3)(1,040)

Deferred loss on derivatives . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2) — (2)

Currency translation adjustments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4(1) 3

Sears Canada de-consolidation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (186) — (186)

Total other comprehensive loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(1,221) $ (4) $(1,225)

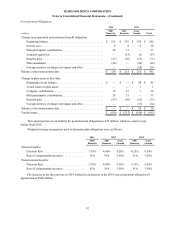

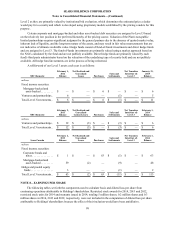

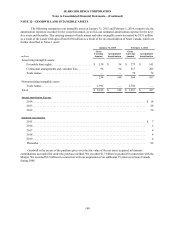

2013

millions

Before

Tax

Amount Tax

Expense

Net of

Tax

Amount

Other comprehensive income

Pension and postretirement adjustments

Experience gain . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 362 $ (126) $ 236

Less: amortization of prior service cost included in net period pension cost .193 (7) 186

Pension and postretirement adjustments, net of tax . . . . . . . . . . . . . . . . . . . . . . . 555 (133) 422

Deferred gain on derivatives. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 — 2

Currency translation adjustments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (70)(1)(71)

Total other comprehensive income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 487 $ (134) $ 353

2012

millions

Before

Tax

Amount

Tax

(Expense)

Benefit

Net of

Tax

Amount

Other comprehensive income

Pension and postretirement adjustments

Experience loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(564) $ 1 $ (563)

Less: cost of settlements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 454 — 454

Less: amortization of prior service cost included in net period pension cost .189 (6) 183

Pension and postretirement adjustments, net of tax . . . . . . . . . . . . . . . . . . . . . . . 79 (5) 74

Deferred gain on derivatives. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 — 5

Currency translation adjustments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (8) 13 5

Total other comprehensive income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 76 $ 8 $ 84

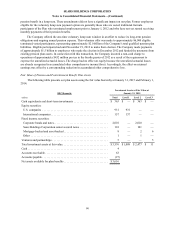

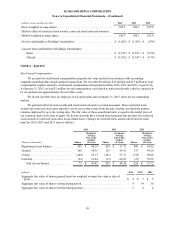

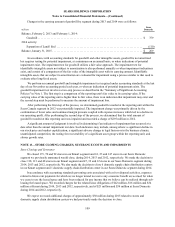

Issuance of Warrants to Purchase Common Stock

On November 21, 2014, the Company issued an aggregate of approximately 22 million warrants pursuant to the

exercise of rights in the rights offering for $625 million in aggregate principal amount of 8% Senior Unsecured

Notes due 2019 and warrants to purchase shares of its common stock. Each warrant, when exercised, will entitle the