Sears 2014 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2014 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

81

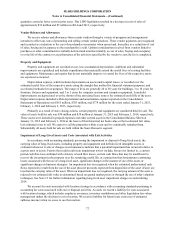

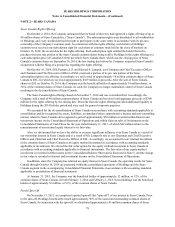

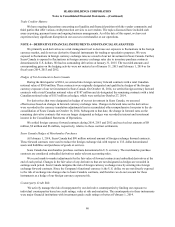

NOTE 3—BORROWINGS

Total borrowings outstanding at January 31, 2015 and February 1, 2014 were $3.8 billion and $4.2 billion,

respectively. At January 31, 2015, total short-term borrowings were $0.6 billion, consisting of a $0.4 billion secured

short-term loan, $0.2 billion of secured borrowings and $2 million of unsecured commercial paper. At February 1,

2014, total short-term borrowings were $1.3 billion, consisting of $1.3 billion secured borrowings and $9 million of

unsecured commercial paper. The weighted-average annual interest rate paid on short-term debt was 3.0% in 2014

and 2.8% in 2013.

Long-term debt was as follows:

ISSUE

January 31,

2015 February 1,

2014

millions

SEARS ROEBUCK ACCEPTANCE CORP.

6.50% to 7.50% Notes, due 2017 to 2043 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 327 $ 327

Term Loan (Credit Facility), due 2018. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 983 991

SEARS HOLDINGS CORP.

6.625% Senior Secured Notes, due 2018 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,238 1,238

8% Senior Unsecured Notes, due 2019 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 352 —

CAPITALIZED LEASE OBLIGATIONS. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 272 346

OTHER NOTES AND MORTGAGES. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13 15

Total long-term borrowings. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,185 2,917

Current maturities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (75)(83)

Long-term debt and capitalized lease obligations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3,110 $ 2,834

Weighted-average annual interest rate on long-term debt. . . . . . . . . . . . . . . . . . . . . . . 6.5% 6.4%

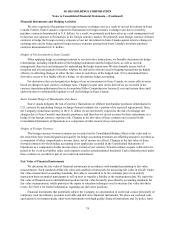

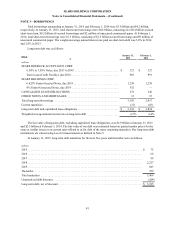

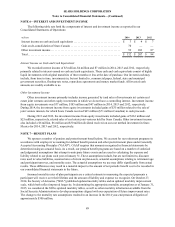

The fair value of long-term debt, excluding capitalized lease obligations, was $2.9 billion at January 31, 2015

and $2.3 billion at February 1, 2014. The fair value of our debt was estimated based on quoted market prices for the

same or similar issues or on current rates offered to us for debt of the same remaining maturities. Our long-term debt

instruments are valued using Level 2 measurements as defined in Note 5.

At January 31, 2015, long-term debt maturities for the next five years and thereafter were as follows:

millions

2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 75

2016 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 66

2017 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 99

2018 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,227

2019 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 643

Thereafter. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 359

Total maturities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,469

Unamortized debt discount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (284)

Long-term debt, net of discount. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3,185