Sears 2014 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2014 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

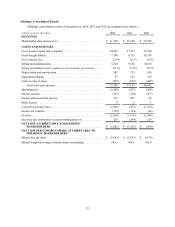

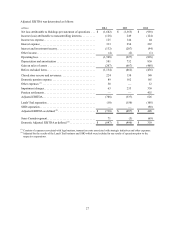

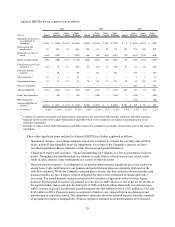

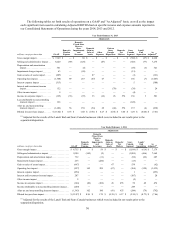

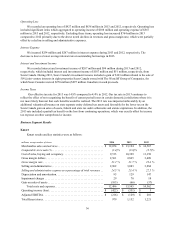

Adjusted EBITDA for our segments was as follows:

2014 2013 2012

millions Kmart Sears

Domestic Sears

Canada Sears

Holdings Kmart Sears

Domestic Sears

Canada Sears

Holdings Kmart Sears

Domestic Sears

Canada Sears

Holdings

Operating income (loss)

per statement of

operations . . . . . . . . . . $(422) $ (920) $ (166) $(1,508) $(351) $ (940) $ 364 $ (927) $ 5 $ (656) $ (187) $ (838)

Depreciation and

amortization. . . . . . . . . 95 437 49 581 129 511 92 732 147 578 105 830

(Gain) loss on sales of

assets . . . . . . . . . . . . . . (103) (105) 1 (207) (66) (63) (538) (667) (37) (261) (170) (468)

Before excluded items . . . (430) (588) (116) (1,134) (288) (492) (82) (862) 115 (339) (252) (476)

Closed store reserve and

severance . . . . . . . . . . . 142 55 27 224 89 (31) 72 130 76 44 20 140

Domestic pension

expense . . . . . . . . . . . . — 89 — 89 — 162 — 162 — 165 — 165

Other expenses (1). . . . . . . 43 4 3 50 — — — — — 9 3 12

Impairment charges . . . . . 29 19 15 63 70 150 13 233 10 25 295 330

Pension settlements . . . . . — — — — — — — — — 452 3 455

Adjusted EBITDA . . . . . . (216) (421) (71) (708) (129) (211) 3 (337) 201 356 69 626

Lands' End separation . . . — (10) — (10) — (150) — (150) — (108) — (108)

SHO Separation . . . . . . . . — — — — — — — — — (90) — (90)

Adjusted EBITDA as

defined (2) . . . . . . . . . . . $(216) $ (431) $ (71) $ (718) $(129) $ (361) $ 3 $ (487) $ 201 $ 158 $ 69 $ 428

% to revenues (3) . . . . . . . . (1.8)% (2.6)% (3.4)% (2.3)% (1.0)% (2.0)% 0.1% (1.4)% 1.4% 0.9% 1.6% 1.2%

(1) Consists of expenses associated with legal matters, transaction costs associated with strategic initiatives and other expenses.

(2) Adjusted for the results of the Lands' End business and SHO which were included in our results of operations prior to the

respective separations.

(3) Excludes revenues of the Lands' End business and SHO which were included in our results of operations prior to the respective

separations.

These other significant items included in Adjusted EBITDA are further explained as follows:

• Impairment charges – Accounting standards require the Company to evaluate the carrying value of fixed

assets, goodwill and intangible assets for impairment. As a result of the Company’s analysis, we have

recorded impairment charges related to certain fixed asset and goodwill balances.

• Closed store reserve and severance – We are transforming our Company to a less asset-intensive business

model. Throughout this transformation, we continue to make choices related to our stores, which could

result in sales, closures, lease terminations or a variety of other decisions.

• Domestic pension expense – Contributions to our pension plans remain a significant use of our cash on an

annual basis. Cash contributions to our pension and postretirement plans are separately disclosed on the

cash flow statement. While the Company's pension plan is frozen, and thus associates do not currently earn

pension benefits, we have a legacy pension obligation for past service performed by Kmart and Sears

associates. The annual pension expense included in our statement of operations related to these legacy

domestic pension plans was relatively minimal in years prior to 2009. However, due to the severe decline in

the capital markets that occurred in the latter part of 2008, and the resulting abnormally low interest rates,

which continue to persist, our domestic pension expense was $89 million in 2014, $162 million in 2013 and

$165 million in 2012. Pension expense is comprised of interest cost, expected return on plan assets and

amortization of experience losses. This adjustment eliminates the entire pension expense from the statement

of operations to improve comparability. Pension expense is included in the determination of Net Income.