Sears 2014 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2014 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

107

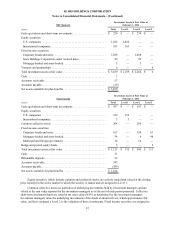

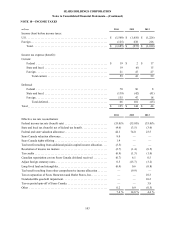

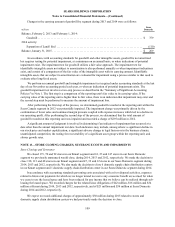

We classify interest expense and penalties related to unrecognized tax benefits and interest income on tax

overpayments as components of income tax expense. At January 31, 2015 and February 1, 2014, the total amount of

interest and penalties recognized within the related tax liability in our Consolidated Balance Sheet was $49 million

($32 million net of federal benefit) and $53 million ($36 million net of federal benefit), respectively. The total

amount of net interest expense recognized in our Consolidated Statement of Operations for 2014 was $4 million.

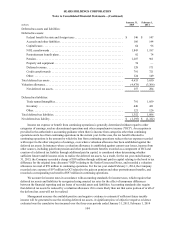

We file income tax returns in both the United States and various foreign jurisdictions. The U.S. Internal

Revenue Service (“IRS”) has completed its examination of all federal tax returns of Holdings through the 2009

return, and all matters arising from such examinations have been resolved. In addition, Holdings and Sears are under

examination by various state, local and foreign income tax jurisdictions for the years 2002 through 2012, and Kmart

is under examination by such jurisdictions for the years 2003 through 2012.

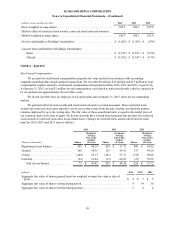

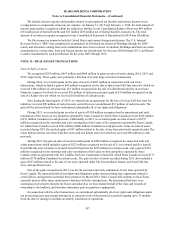

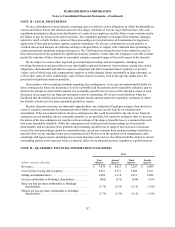

NOTE 11—REAL ESTATE TRANSACTIONS

Gain on Sales of Assets

We recognized $207 million, $667 million and $468 million in gains on sales of assets during 2014, 2013 and

2012, respectively. These gains were primarily a function of several large real estate transactions.

During 2014, we recorded gains on the sales of assets of $207 million in connection with real estate

transactions, which included a gain of $64 million recognized on the sale of three Sears Full-line stores for which we

received $106 million of cash proceeds, $13 million recognized on the sale of a distribution facility in our Sears

Domestic segment for which we received $16 million of cash proceeds and a gain of $10 million recognized on the

sale of a Kmart store for which we received $10 million of cash proceeds.

Also, during the third quarter of 2014, we entered into an agreement for the sale of a Sears Full-line store for

which we received $90 million of cash proceeds, and will receive an additional $12 million of cash proceeds. The

gain will be deferred until we have surrendered substantially all of our rights and obligations.

During 2013, we recorded gains on sales of assets of $180 million recognized on the amendment and early

termination of the leases on two properties operated by Sears Canada for which Sears Canada received $184 million

($191 million Canadian) in cash proceeds. Additionally, in 2013, we recorded gains on sales of assets of $357

million recognized on the surrender and early termination of the leases of five properties operated by Sears Canada,

for which Sears Canada received $381 million ($400 million Canadian) in cash proceeds. Gains on sales of assets

recorded during 2013 also include gains of $67 million related to the sale of one store previously operated under The

Great Indoors format, two Sears Full-line stores and two Kmart stores for which we received $98 million in cash

proceeds.

During 2012, the gain on sales of assets included gains of $386 million recognized in connection with real

estate transactions which included a gain of $223 million recognized on the sale of 11 (six owned and five leased)

Sears Full-line store locations to General Growth Properties for $270 million in cash proceeds, and a gain of $163

million recognized on the surrender and early termination of the leases on three properties operated by Sears

Canada, under an agreement with The Cadillac Fairview Corporation Limited for which Sears Canada received $171

million ($170 million Canadian) in cash proceeds. The gain on sales of assets recorded during 2012 also included a

gain of $33 million related to the sale of one store operated under The Great Indoors format, one Sears Full-line

store, and one Kmart store.

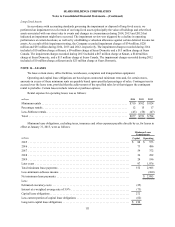

One of the gains recognized in 2013 was for the surrender and early termination of one lease operated by

Sears Canada. We surrendered all of our rights and obligations under our preexisting lease agreement related to

certain floors, and agreed to surrender these premises by March 2014. Sears Canada will continue to lease floors

currently used as office space under terms consistent with the existing lease. We determined that there is no

continuing involvement related to the floors surrendered as we have transferred all of the risks and rewards of

ownership to the landlord, and therefore immediate gain recognition is appropriate.

In connection with the other transactions, we surrendered substantially all of our rights and obligations under

our preexisting lease agreements and agreed to surrender each of the premises in periods ranging up to 23 months

from the date of closing to facilitate an orderly wind down of operations.