Sears 2014 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2014 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

82

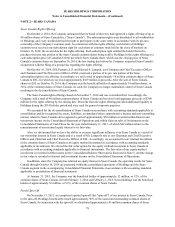

Interest

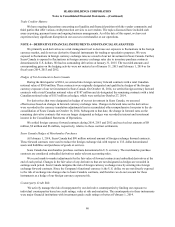

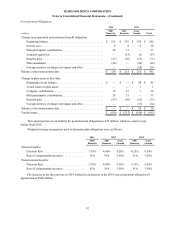

Interest expense for years 2014, 2013 and 2012 was as follows:

millions 2014 2013 2012

COMPONENTS OF INTEREST EXPENSE

Interest expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 238 $ 193 $ 198

Amortization of debt issuance costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38 21 18

Accretion of self-insurance obligations at net present value . . . . . . . . . . . . . . . . . . . . . . 22 24 34

Accretion of lease obligations at net present value . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15 16 17

Interest expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 313 $ 254 $ 267

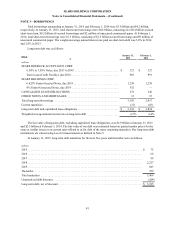

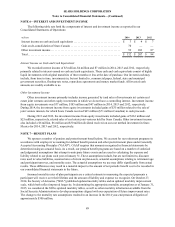

Debt Repurchase Authorization

In 2005, our Finance Committee of the Board of Directors authorized the repurchase, subject to market

conditions and other factors, of up to $500 million of our outstanding indebtedness in open market or privately

negotiated transactions. Our wholly owned finance subsidiary, Sears Roebuck Acceptance Corp. ("SRAC"), has

repurchased $215 million of its outstanding notes. In 2011, Sears Holdings repurchased $10 million of Senior

Secured Notes, recognizing a gain of $2 million. The unused balance of this authorization is $275 million.

Unsecured Commercial Paper

We borrow through the commercial paper markets. At January 31, 2015 and February 1, 2014, we had

outstanding commercial paper borrowings of $2 million and $9 million, respectively. ESL held none of our

commercial paper at January 31, 2015 or February 1, 2014, including any held by Edward S. Lampert. See Note 15

for further discussion of these borrowings.

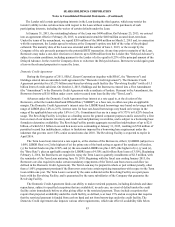

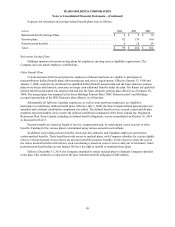

Secured Short-Term Loan

On September 15, 2014, the Company, through Sears, Sears Development Co. and Kmart Corporation

("Borrowers"), entities wholly-owned and controlled, directly or indirectly by the Company, entered into a $400

million secured short-term loan (the "Loan'") with JPP II, LLC and JPP, LLC (together, the "Lender"), entities

affiliated with ESL. The first $200 million of the Loan was funded at the closing on September 15, 2014 and the

remaining $200 million was funded on September 30, 2014. Proceeds of the Loan were used for general corporate

purposes.

The Loan was originally scheduled to mature on December 31, 2014. As permitted by the Loan agreement, the

Company paid an extension fee equal to 0.5% of the principal amount to extend the maturity date to February 28,

2015. The Loan has an annual base interest rate of 5%. The Borrowers paid an upfront fee of 1.75% of the full

principal amount.

The Loan is guaranteed by the Company and is secured by a first priority lien on certain real properties owned

by the Borrowers. In certain circumstances, the Lender may exercise its reasonable determination to substitute one

or more of the properties with substitute properties. The Loan includes customary representations and covenants,

including with respect to the condition and maintenance of the real property collateral.

The Loan has customary events of default, including (subject to certain materiality thresholds and grace

periods) payment default, failure to comply with covenants, material inaccuracy of representation or warranty, and

bankruptcy or insolvency proceedings. If there is an event of default, the Lender may declare all or any portion of

the outstanding indebtedness to be immediately due and payable, exercise any rights it might have under any of the

Loan documents (including against the collateral), and instead of the base interest rate, the Borrowers will be

required to pay a default rate equal to the greater of (i) 2.5% in excess of the base interest rate and (ii) the prime rate

plus 1%. The Loan may be prepaid in whole or in part any time prior to maturity, without penalty or premium.