Sears 2014 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2014 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

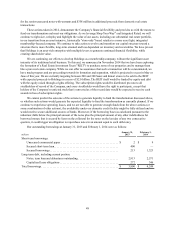

For purposes of determining the periodic expense of our defined benefit plan, we use the fair value of plan

assets as the market related value. A one-percentage-point change in the assumed discount rate would have the

following effects on the pension liability:

millions 1 percentage-point

Increase 1 percentage-point

Decrease

Effect on interest cost component. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 29 $ (37)

Effect on pension benefit obligation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (602) $ 728

Income Taxes

We account for income taxes according to accounting standards for such taxes. Deferred tax assets and

liabilities are recognized for the future tax consequences attributable to differences between the book basis and tax

basis of assets and liabilities. Deferred tax assets and liabilities are measured using enacted tax rates expected to

apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. If

future utilization of deferred tax assets is uncertain, the Company may record a valuation allowance against its

deferred tax assets. In evaluating our ability to recover our deferred tax assets within the jurisdiction from which

they arise, we consider all available positive and negative evidence, including scheduled reversals of deferred tax

liabilities, projected future taxable income, tax planning strategies, and results of recent operations. In projecting

future taxable income, we begin with historical results adjusted for the results of discontinued operations and

changes in accounting policies and corporate assumptions including the amount of future state, federal and foreign

pre-tax operating income, the reversal of temporary differences, and the implementation of feasible and prudent tax

planning strategies. In evaluating the objective evidence that historical results provide, we consider cumulative

operating income (loss) over the past several years. These assumptions require significant judgment about the

forecasts of future taxable income. After consideration of evidence regarding the ability to realize our deferred tax

assets, we established a valuation allowance against deferred income tax assets in 2014, 2013 and 2012. In 2014, the

Company increased its valuation allowance by $1.1 billion, of which $454 million was recorded through other

comprehensive income. The Company continues to monitor its operating performance and evaluate the likelihood of

the future realization of these deferred tax assets.

Income tax expense or benefit from continuing operations is generally determined without regard to other

categories of earnings, such as discontinued operations and other comprehensive income ("OCI"). An exception is

provided in the authoritative accounting guidance when there is income from categories other than continuing

operations and a loss from continuing operations in the current year. In this case, the tax benefit allocated to

continuing operations is the amount by which the loss from continuing operations reduces the tax expense recorded

with respect to the other categories of earnings, even when a valuation allowance has been established against the

deferred tax assets. In instances where a valuation allowance is established against current year losses, income from

other sources, including gain from pension and other postretirement benefits recorded as a component of OCI and

creation of a deferred tax liability through additional paid-in capital, is considered when determining whether

sufficient future taxable income exists to realize the deferred tax assets. As a result, for the year ended January 31,

2015, the Company recorded a charge of $59 million through additional paid-in capital relating to the book to tax

difference for the original issue discount ("OID") relating to the Senior Unsecured Notes, and recorded a valuation

allowance reversal of $59 million in continuing operations. For the tax year ended February 1, 2014, the Company

recorded a tax expense of $97 million in OCI related to the gain on pension and other postretirement benefits, and

recorded a corresponding tax benefit of $97 million in continuing operations.

Significant management judgment is required in determining our provision for income taxes, deferred tax

assets and liabilities and the valuation allowance recorded against our net deferred tax assets, if any. As further

described above, management considers estimates of the amount and character of future taxable income in assessing

the likelihood of realization of deferred tax assets. Our actual effective tax rate and income tax expense could vary

from estimated amounts due to the future impacts of various items, including changes in income tax laws, tax

planning and the Company's forecasted financial condition and results of operations in future periods. Although

management believes current estimates are reasonable, actual results could differ from these estimates.